Total invested

Grow your money effortlessly

years

Keep investing and see how much more you could earn over the next 9 years

Grow your money effortlessly

Why invest with Bondora

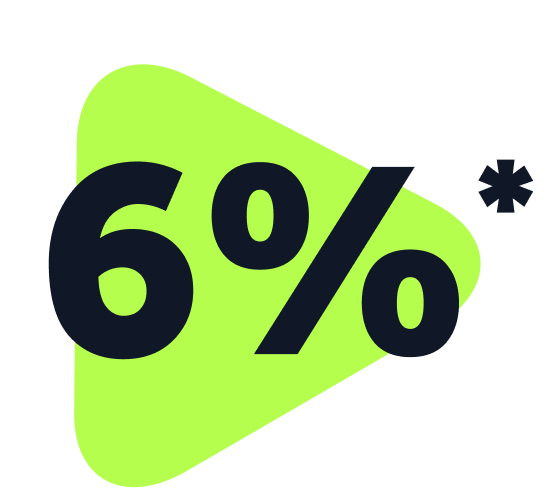

Earn up to around 6%* p.a.

Start from just €1

Withdraw anytime

What is Go & Grow?

This diversification happens automatically. So, when you add money to your account, it automatically invests in Go & Grow, and you start earning daily returns.

Ready to grow?

Yes, that’s how much you could earn on your entire Go & Grow portfolio. All day. Every day.

7,000+ reasons to love Bondora

Your questions, answered

- What is Go & Grow?

Go & Grow is your simplest way to invest with Bondora! It’s an online investing portfolio made up of diversified loan fractions. These loans are from verified Bondora customers in Estonia, Finland, the Netherlands, Spain and Latvia.

The high diversification of our portfolio means the loans are from different risk-ratings. The balanced split of these loan pieces is what makes Go & Grow a lower-risk investment option.

Because we believe investing should be simple, all of this diversification happens automatically, meaning you don’t have to select or change settings or monitor anything. Just add money to your account, and you’ll automatically invest in Go & Grow. And from the get-go, your money will work for you, and you can start earning daily returns.

- How much could I earn?

With Go & Grow, your entire investment earns up to around 6%* p.a.

- What are the fees?

You pay no fees to invest! There’s only a €1 withdrawal fee, no matter the amount you withdraw.

- Is Bondora safe?

Founded in 2008, Bondora has grown into an international company of about 200 employees. Today, we can proudly call ourselves one of Europe’s most established online investment companies.

For more than 16 years, our customers have invested with peace of mind thanks to our diverse investment portfolio. Higher diversification means lower risks. And since launching Go & Grow in 2018, our investors have been enjoying steady returns.All the information customers provide is kept private, confidential, and on secure servers. We have a host of safeguards that comply with legal requirements and help safeguard our customers‘ information and money, such as AML & KYC processes, consumer protection, data protection GDPR, Two-Factor Authentication, and online verification. We have internal teams who are constantly maintaining and improving our technology and information-safeguarding processes.

Bondora AS operates as a Licensed Credit Provider and is supervised by the Finnish Regional State Administrative Agency, as well as the Estonian Financial Supervision Authority (FSA). Our lending activities must comply with local legislation, good practice, and responsible lending principles.

- I'm a beginner, can I invest with Bondora?

Absolutely, yes! Simple investing is our thing. It’s easy, automated, and beginner everyone-friendly. You don’t need to buy or sell, track price trends, follow daily news, or know whether it’s a bear or a bull market.

Just invest, earn returns daily, and withdraw when you want to. We’ll take care of the rest.

- Where is Bondora based?

We’re based in Tallinn, Estonia. However, our online investing services are available across Europe.

- Is Bondora a P2P lending platform?

Although our roots were in peer-to-peer lending, we have since grown to be much more than that. We’ve fully embraced our mission to give our investors the easiest and simplest way to invest online. And as a European fintech company, we’re always looking for new and innovative ways to improve your experience with us.

- How does the refer-a-friend reward program work?

When your friends sign up using your unique Bondora referral link, they’ll get a €5 starting bonus. When they invest €50 or more in the first 30 days, you’ll get a €5 referral bonus. Terms & conditions apply.

Join investors

Join 506,885 investors

Curious to know more?

Get started in 3 simple steps

Ready

Set

Grow