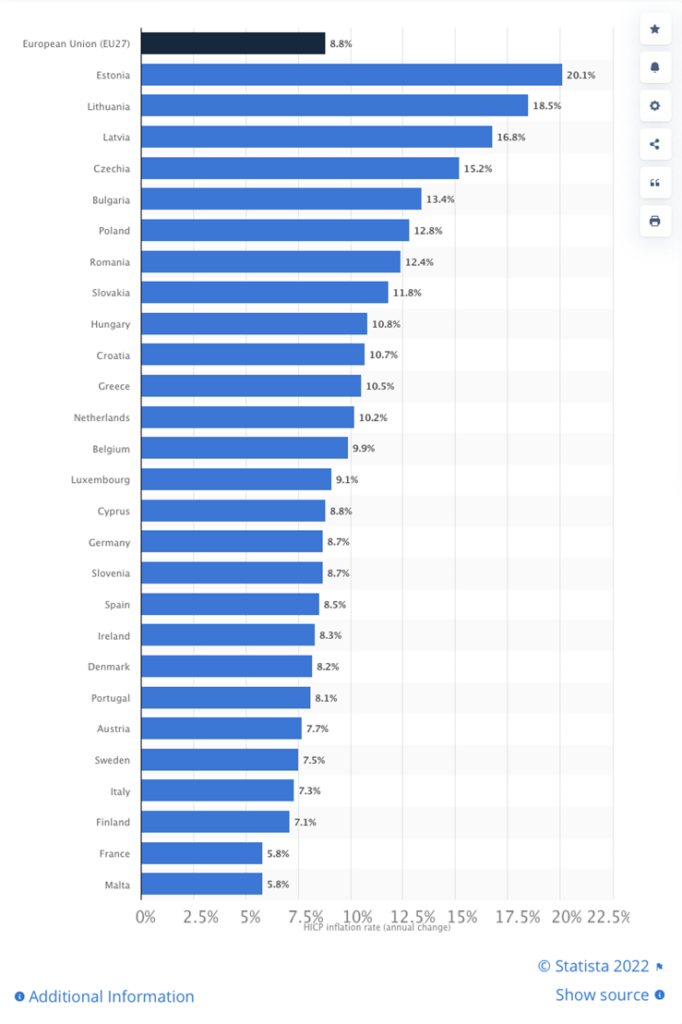

In May 2022, the average inflation rate in the EU reached a staggering 8.8%. While in France it didn’t exceed 6%, the 20% inflation rate in Estonia or the 15% one in the Czech Republic makes one wonder — will the situation stabilize?

Here is the thing—whether it’s 6% or 20%—a growing inflation rate means you can buy less with the money you have.

With this current economic situation, you might ask yourself: “Is it the right time to save money?” Indeed, it is. The longer you keep your money sitting idly in a bank account or in cash stashed under your mattress, the more you lose to inflation every day.

So, what can you do now to offset the negative impact inflation has on your wallet and, ultimately, your life goals? Let’s take a look:

Saving money when inflation is rising

Rampant inflation means that the price of everything increases. You are forced to spend more money on insurance, mortgages, as well as essential expenses, like groceries, and water and energy bills. This all means you have much less money to set aside for saving and investments now than in the past.

For those who don’t have any financial buffer, a high inflation rate means less stability, more emotional discomfort, and a more unpredictable environment to live in.

To get through tough times with less financial stress, you should save for emergency situations and, if you have some excess money, invest it before it gets devalued.

Here are 5 tips that can help you to implement both saving and investing strategies:

1. Build an emergency fund

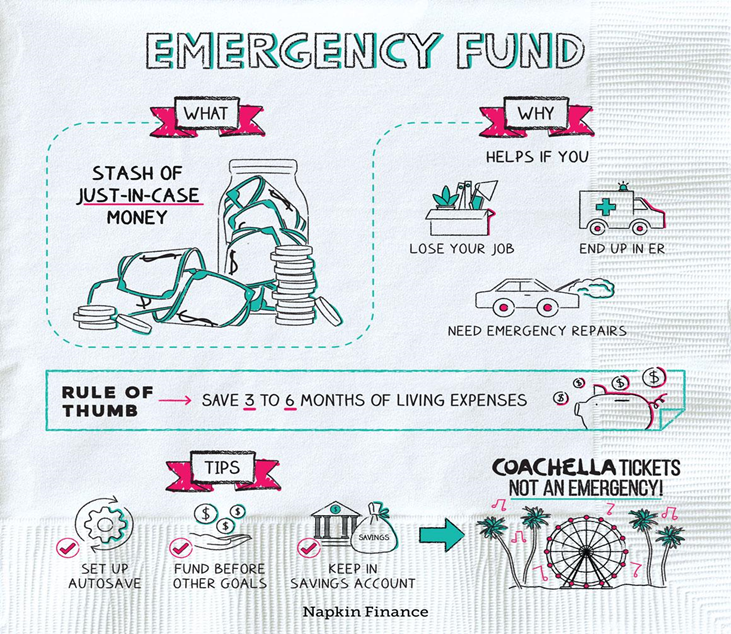

Creating an emergency fund is a good way to prevent bad financial situations when unexpected expenses come up. Imagine your insurance or electricity bill suddenly goes up, but you didn’t account for this when budgeting. When inflation is high, these situations tend to arise more often.

To create a financial buffer (AKA an emergency fund), you should set aside a certain amount of money every month. But what amount is the most optimal? Well, your emergency fund should cover at least three months’ expenses, if you were to lose your regular income.

The size of your emergency fund depends on your current life situation—whether or not you have family members to support, a mortgage to pay, and the level of psychological comfort you need.

Once you have evaluated the right amount you need to set aside, it’s time to think of how much money you can save.

To start building your fund, keep in mind your monthly savings goal and transfer the necessary amount to your savings or investment account every month, before you spend money on other expenses. Read our Emergency Fund 101 article for more helpful tips.

2. Continue investing

If you have invested some money in the past—whether in bonds or property—great! But you don’t have to stop there.

When thinking of new ways to invest your money, calculate the return on investment necessary to, at least reasonably, offset the negative impact of inflation. For example, if inflation is at 6%, you’d look for some investment products that would give you at least 6.5-7% in return.

However, as in some countries, inflation is currently far over 10%, it’s becoming increasingly difficult to find investment products that can offset such a high inflation rate. In these cases, finding investment products that give you the highest returns and align with your risk appetite will help you minimize losses.

Always keep in mind your ROI and avoid investing in things that quickly lose their initial value—such as buying a brand-new car or investing in refurbishing an apartment.

3. Spend less

Experts claim you can save more only by changing two things — spending and earnings.

Earning more often means getting more qualifications and experience and investing effort and time in finding new projects. In contrast, by cutting spending, you can see the effect much faster. So, how can you spend less without hurting your standard of living?

To start, make an Excel sheet where you can list all the financial information from your bank accounts. The idea here is to understand the key categories of expenditure and evaluate where most of your money goes.

The next step would be thinking of the products or services that you can stop spending money on. Here are some things you could cut:

- Monthly subscriptions (Netflix, audiobooks, fitness apps, etc.)

- Eating out

- Internet (move to a less expensive provider)

- Clothes (set up limits on shopping expenses)

- Bills

And a few more ideas:

When aiming to cut your expenses, don’t be too extreme. Sometimes, skipping dinner with friends can cause a much bigger decrease in your quality of life and emotional comfort than skipping a visit to a designer shop. Evaluate options in a smart way and find solutions that suit your needs best.

4. Earn more

To save more, you can also consider increasing your earnings. Easier said than done, right? However, you don’t always have to spend a lot of time increasing your qualifications to notice an increase in monthly earnings.

There are some quick ways to get extra cash to complement your emergency fund or free up money for investment. Here are some ideas you can consider:

- Talk to your employer to adjust your salary based on the current inflation rate

- Sell things you are no longer using on portals, such as eBay or Facebook Marketplace

- Look for side gigs (tutoring, pet-sitting, consulting, etc.)

And don’t forget the earnings from your investments! For example, with our Go & Grow online investment account, you can earn up to 6.75% p.a.* from the money invested. Plus, you can withdraw at any time as it has fast liquidity.

5. Buy bonds

Buying bonds is one of the many ways to preserve your savings and prevent them from devaluing during times of high inflation.

Locating money in bonds often means you ‘freeze’ the money for a certain period of time.

On the market, you can find many products: short-, intermediate-, and long-term bonds.

Investing in long-term bonds can be a much riskier idea with high inflation, as the waiting returns period is the longest. It’s usually better to choose short-term bonds when inflation is high because the issuer will pay it out relatively fast.

Bonds are also a way for you to diversify your portfolio, making it more bullet-proof against rapid market changes.

In summary

Inflation brings uncertainty and decreases consumer purchasing power. It’s worth saving and reinvesting your money to feel more confident during difficult economic times. Hopefully, with the tips in this article, it will be easier to make smarter financial decisions and ensure you can continue to build your wealth regardless of high inflation rates.