Bondora returns are holding strong. In fact, investor returns for 2021 originations were higher in July compared to June. Here is our main takeaway for July’s portfolio performance:

Key statistics

- Originations returned a higher rate of 15.2% for 2021 originations

- There was a 1.3% increase in returns for 2021 Q2 originations

- An outlier in Estonia saw returns in AA-rated originations for 2021 Q2 fall to -13.0%

- Returns on Finnish originations for the most recent quarter were 0.5% higher than in June

As always, country-specific performance charts are broken down by the number of loan issuances over the given period, with Orange representing < 50 loans, Blue 51-200, and White > 200.

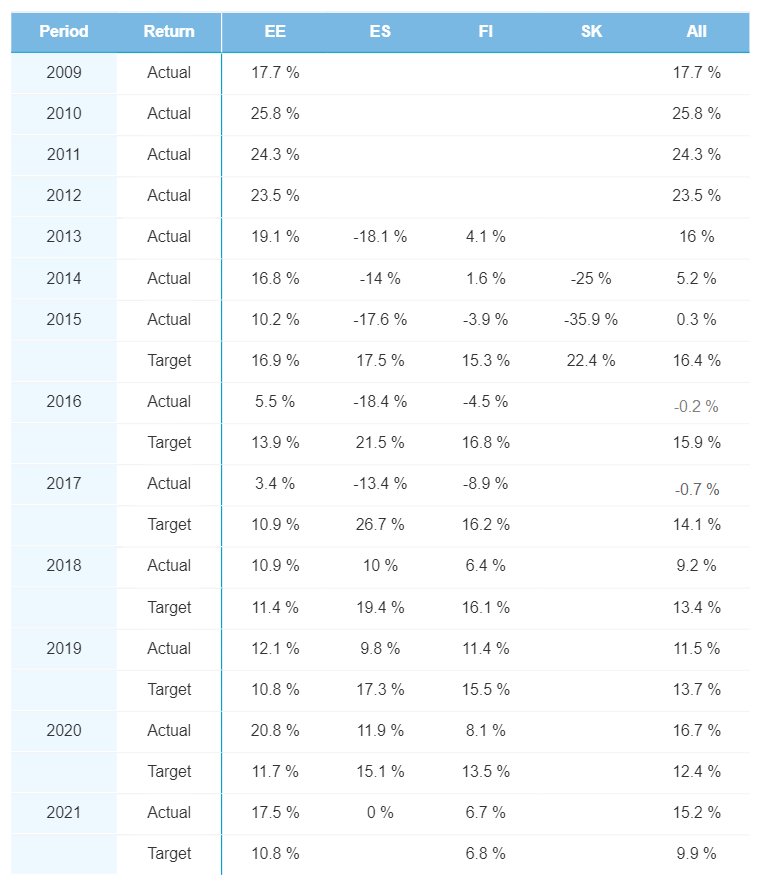

Yearly performance

The 15.2% return rate for 2021 originations was 0.1% higher than last month. This was led by Estonian originations, which came in 0.2% higher to 17.5%. However, Finnish returns fell below their target rate this month, at 6.7%. 2017 returns grew as well, up by 0.2% to 0.7%.

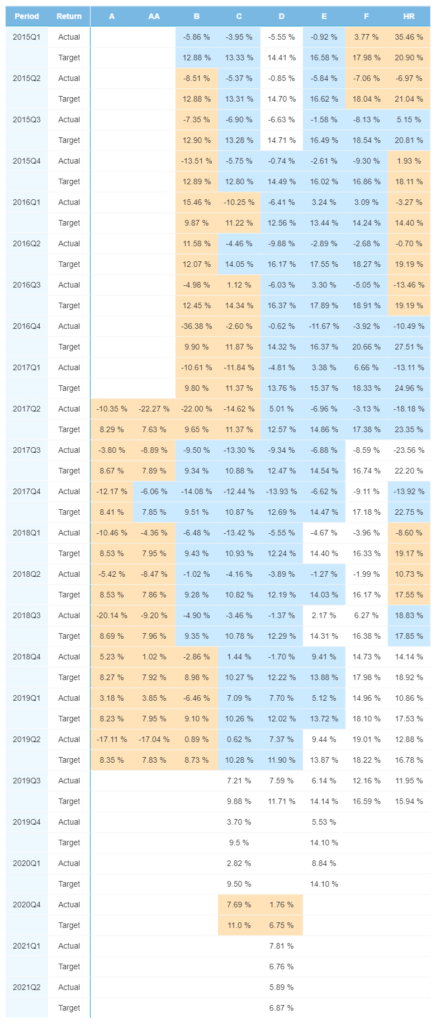

Quarterly performance

The most recent quarter of 2021 Q2 came in with extremely strong returns at 12.6%, representing a 1.3% increase month-over-month. The previous quarter, 2021 Q1, saw its returns drop by only 0.1% to 16.9%, still well above its 10.2% target rate. All told, the most recent six quarters had return rates above their targets.

Finland

A 5.9% return rate for D-rated Finnish loans—the only origination category in 2021 Q2—was higher than June’s 5.4% rate. However, it’s still below the target rate of 6.9%. In July, the most significant change was with 2020’s Q4 originations: D-rated loans’ returns fell from 8.5% to 1.8%.

Estonia

AA-rated originations for 2021 Q2 fell dramatically from 0.1% to -13.0% this month. Although, this seems like an outlier when compared to other rating categories for this quarter. Apart from AA-rated originations, all other rating categories’ return rates increased compared to the previous month. The highest returns come, once again, from E-rated originations at an impressive 24.3%.

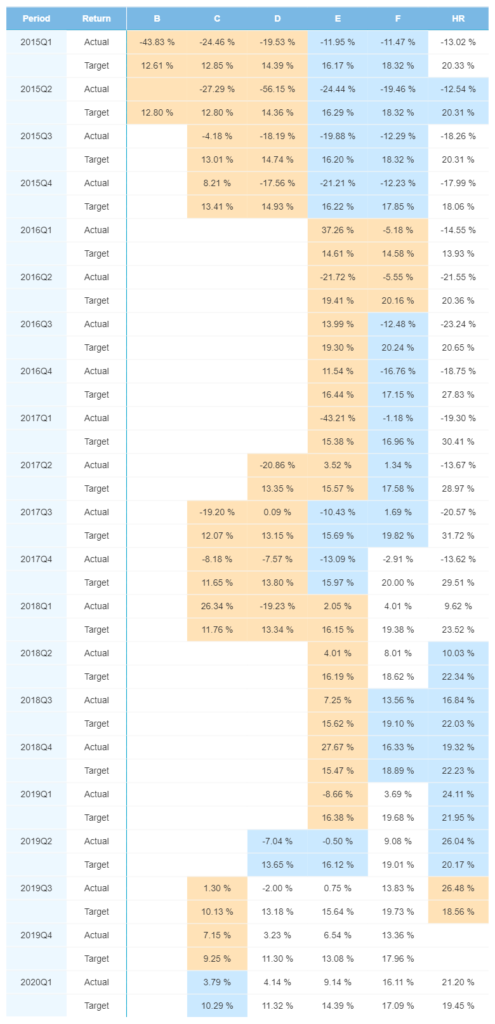

Spain

Originations in all five rating categories had lower returns for 2020 Q1 originations. F-rated originations dropped to a 16.1% return rate, slightly below its 17.1% target. The same trend can be seen in almost all the previous few quarters.

Conclusion

It was another solid month of returns for Bondora originations. When compared to June, returns were overall higher for the most recent quarter of originations, while previous quarter returns are still holding strong.