When it comes to financing, the earlier you start, the better. Whether it’s budgeting, investing, or managing debt, the sooner you take control of your personal financial life, the more prepared you will be for your future. In your 20’s you might still be thinking about how to land your first steady job or move out of your parents’ house, but that doesn’t mean you can’t prepare yourself for the road ahead.

Here are the basics of personal finance you should know in your 20’s. And even if you are past your 20’s, you can still take the time to understand these principles. After all, it’s never too late to be financially prudent.

Better finances = A better life

No, money can’t buy you happiness. But financial knowledge can undoubtedly afford you more of the security and prosperity you are hoping for as you age. Studies have shown that, on average, an increase in financial knowledge actually leads to more happiness. This also applies to those who have a more positive outlook on financial literacy and education. Of course, earning and saving more money is associated with a better sense of wellbeing too, but even for those that don’t earn a six-figure salary, simply learning how to improve your financial situation will lead toward better outcomes.

Earnings > Spending

We know this one might sound like the basic of all necessary financial guidelines, but you’d be surprised at how many people disregard this tip. It doesn’t matter if you can spend more money by maxing out your credit cards or taking out a loan; if you are consistently spending more money than you earn, you will never get your head above water.

The best way to accomplish this is to live below your means. If you purchase a home that is not at the max of your budget and cruise around in an affordable car, you will increase the gap between what you earn and what you spend. In other words, you will create more of an opportunity to save money for the future.

Budget

Do you really know what you can afford? Or do you simply spend money each month and hope that you’ll have some savings left? Take the guesswork out of your finances by creating detailed budgets for your income and expenses each month. You can review previous months’ expenses and plan for any future costs that come up. Budgeting doesn’t have to be hard. Take a look at our overview of how to create your own budget here.

Credit cards are good and bad

Using a credit card for everyday purchases in and of itself isn’t bad. Credit cards can provide you with free money in the form of points and/or rewards. However, credit cards’ interest rate is notoriously high, which makes carrying debt on your credit card a big no. Do everything you can to pay off your credit card debt each month, even if that means forgoing payments on other debt with lower interest rates.

Understanding compound interest, your new best friend

If you’ve managed to save some money, do yourself a favor and don’t just put it under your mattress or even in a simple checking account. Instead, let your money work for you. Investing using compound interest allows your money to grow on top of itself, creating exponential wealth growth. People who invest using compound interest at an early age grow their wealth much quicker than those who start later.

Inflation hurts

Have you stopped to think why it seems the price of your favorite thing as a child seems to keep rising over the years? This is inflation, which causes prices to rise and the purchasing value of money to decline. Inflation exists across all currencies around the globe, with some experiencing it worse than others. As prices increase, you need more and more money to afford the same things you bought in the past.

This makes investing your money all the more important, so your money can grow at a rate faster than inflation. This means your purchasing power can rise as well. But don’t worry, investing today is easier than ever.

Investing is more accessible today than ever before

Decades ago, only the ultra-wealthy had an opportunity to invest their money. But today, the field of investing has been completely democratized so that you can invest no matter how much money you have. Fintech platforms like Bondora and its Go & Grow investment option have made it easier than ever to invest any amount of money you want and grow your savings over time. You can start with as little as €1!

Don’t forget that emergency fund

As excited as you might be to start investing and earning compound interest, pump the breaks for just one moment. Your first step before investing should always be to secure an emergency fund. While you hope never to use it, an emergency fund will come in handy should something unexpected occur in your life. For instance, if you suddenly get laid-off from your job, an emergency fund will be there to support you while you back on your feet.

Take care of your health

If you regularly take care of your body and mind, you will also be taking care of your money at the same time. That’s because medical bills are a leading cause of financial stress worldwide, with more than 10% of global GDP spent on healthcare-related costs every year.

The things you can do to take care of your body are quite obvious: exercise regularly and eat a healthy diet. But don’t forget to take care of your mind as well. This means reducing your stress, taking time for yourself, and communicating your needs with loved ones. You can even try some relaxation practices like yoga or meditation to keep your mind calm and ready for anything that might come your way.

Start thinking about retirement today

It might be 40 years away, but there is no better time to start thinking about retirement than today. Studies show that the earlier you save, the more your retirement savings will grow, and you will be more likely to retire at an earlier age. You can start small and save only a tiny fraction of your earnings toward your retirement each month. But even this small act will get you moving in the right direction.

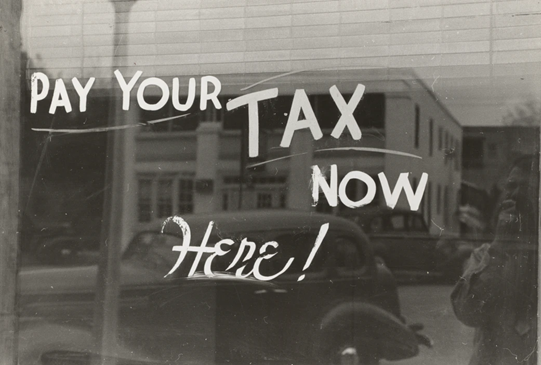

Don’t let taxes catch you by surprise

No matter how hard you try, you can’t avoid the taxman. While your paycheck’s top line looks great, it’s best to understand now that the number you see isn’t what is going into your pocket at the end of the day. No one likes paying taxes, but they are necessary to maintain public services for everyone.

If you are a salaried employee, your taxes will be taken out of your paycheck automatically. But, if you are a contract worker, it is your job to set aside part of your income that will be used to pay taxes at the end of the year. To help you do this, you should open a separate bank account and set aside 20-30% of your earnings every month for taxes. This way, you won’t be surprised at the end of the year when you see your tax bill.

Don’t wait to build your financial future

Having the life you want is not going to happen all by itself. You are going to have to work for it. And the earlier you begin your quest for financial freedom, the better. Even in your 20’s you can begin to apply these basic principles and stay ahead of the curve, managing your finances, investing, and growing your wealth along the way. If there is one thing that most people regret when it comes to their financial lives, it’s that they didn’t get started sooner. Don’t let another day go by without learning and applying that financial knowledge to your life.

The best gift you can give yourself is financial education, so why not start today?