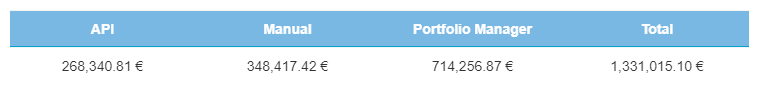

March saw a bigger rise in Bondora secondary transactions. In total, €1,331,015 was transacted on the Secondary Market, a 58.8% increase from the previous month. While all categories were higher, Portfolio Manager had the biggest increase, jumping by 92.6% higher to €714,256.

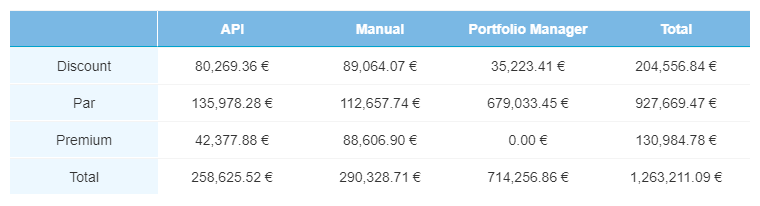

Current Loans

Transactions of current loans surpassed €1 million, hitting a total of €1,263,211 on the month. Discount transactions jumped close to ten-fold, coming in at €204,556. Meanwhile, Portfolio Manager transactions almost doubled to €714,256.

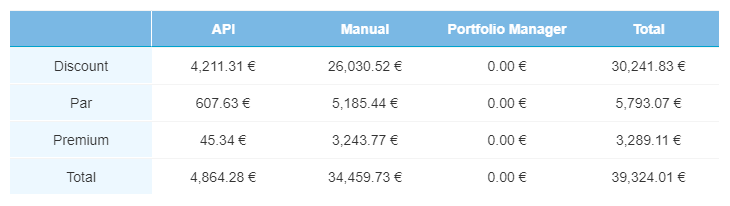

Overdue Loans

Overdue loan transactions were 35.4% higher than in February, totaling €39.324 on the month. The vast majority of overdue loan transactions (87.6%) remain manual transactions, with a small amount (12.4%) coming in as API transactions.

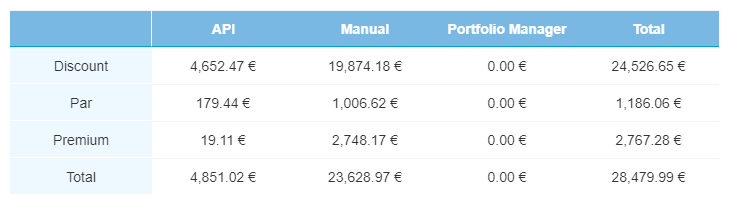

Defaulted Loans

Unlike the rest of the Secondary Market, defaulted loan transactions were lower on the month, dropping by 50.4% to €28,479. API transactions were higher, up to €4,851, while it was Manual transactions that were significantly lower, down by 56.3% on the month.

Investors look for liquidity

In March, Bondora investors utilized the Secondary Market more than in months past. It is in times of economic uncertainty such as these that investors seek investment liquidity to keep them feeling secure. Luckily, the Secondary Market provides Bondora investors a great way to sell their p2p loans in times of need, or seek to purchase loans at a fair price from other investors.

Always remember, investors should not seek higher returns from buying and selling loans on the Bondora secondary market.

You can learn more about the Bondora secondary market here, or contact an experienced Investor Relations Associate at [email protected].

*As with any investment, your capital is at risk. Investments made through Bondora are not guaranteed; therefore any assets allocated to the Go & Grow account are not guaranteed by any state fund or otherwise secured and it may not be possible to liquidate assets or withdraw money immediately. The yield is up to 6.75% p.a., but please note that the yield achieved in past periods does not guarantee the rate of return in the future. Before deciding to invest, please review our risk statement or consult with a financial advisor if necessary.