Most Bondora investors prefer the speed and automation of the Portfolio Manager tool. However, diversification is an equally important parameter for investors. Each user has a different risk tolerance which is balanced with an expected return goal. At Bondora we strive to achieve efficient investments without sacrificing diversification.

Balance between risk tolerance and expected return goal

Diversification is a risk mitigating strategy. Investors also manage risk by pursuing low-risk loans with attractive Bondora ratings. The Portfolio Manager tool is designed to strike a balance between investment speed, diversification levels and chosen investment strategy. In this post we share an overview of how the Portfolio Manager engineers investment selection based on the criteria provided by the investor.

Our system begins the process of executing an investment by calculating the suggested bid size and maximum bid size provided. In principle, the system is designed to account for

(a) the funds available for investment,

(b) the point of diversification–the number of loans the funds should invest in–and finally,

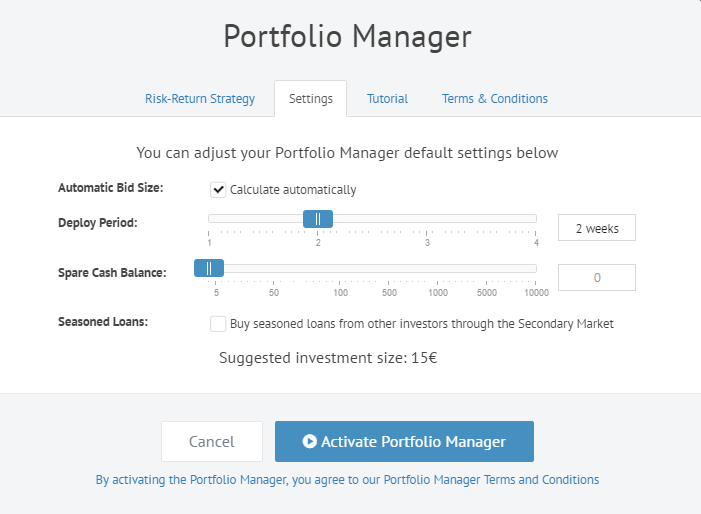

(c) the deploy period in which the funds should be invested.

These three parameters are key factors in obtaining the investors expected return goals and keeping the portfolio diversification as optimal as possible.

Calculating the investment sizes

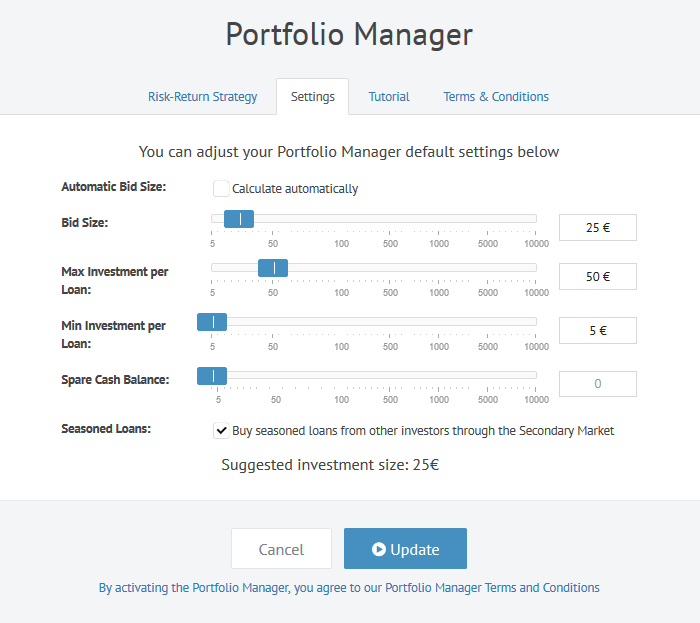

Next, the system relies on the three sizes of investments: minimum investment (5 EUR), suggested investment and maximum investment. To arrive at a suggested investment size, the system uses an algorithm comprised of six parts:

- Level of diversification (X).

- Desired capital deployment period.

- Expected number of loans available for the period (Z).

- Total deposits (T).

- Available cash balance (C).

- Expected cash flow over deployment period (CF).

Suggested investment size calculation

Using these data points the suggested investment size is calculated by dividing the available cash balance (C) and expected cash flow (CF) over the defined deployment period with expected number of loans available during the period (Z).

Simplified, this calculation is: (C + CF) / Z.

Example: 5000€ + 250€ / 150 loans = 35€

Maximum investment size calculation

To calculate the maximum investment size the system uses a different equation. The system divides the total deposits (T) with the level of diversification (X). The level of diversification (the number of loans needed for proper diversification) has a system default of 200.

Simplified, the calculation is: (T) / (X)

Example: 10000€ / 200 loans = 50€

Customize your investment settings

Users can customize some of the settings which control the six components listed above when they want to override the automatic settings. These changes can be made in the advanced settings of the Portfolio Manager. For example, a you can adjust your bid sizes or capital deployment period. Other settings allow for changes to your “Spare cash balance” which designates how much money you want to keep out of investments for occasional withdraws.

It is important to remember the a “conservative” strategy within the Bondora framework is purely contextual. That is, a conservative approach in the Bondora system is not comparable to a conservative approach in the equities and bond markets.

Finally, the Portfolio Manager occasionally buys from the Secondary Market. However, if a user is interested only in new originations then you can elect to disable this option in the Portfolio Manager Advanced Settings.