Bondora originations saw an uptick in February, led once again by growing Finnish originations. A total of €6,462,732 was originated in February, representing 4.5% growth compared to January originations.

Country breakdown

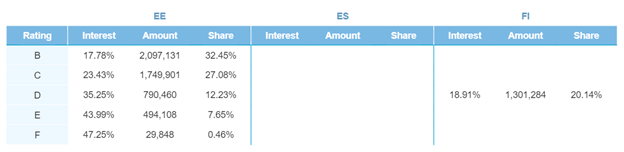

After growing 181.0% last month, Finnish originations continued their sizable growth rate. This time, originations out of Finland totaled €1,301,284—a 95.2% increase month-over-month. This brought the share of Finnish loans to 20.1% of all Bondora originations. This is quite the increase compared to 10.8% in January. Meanwhile, Estonian originations fell slightly, down 6.5% to €5,161,448.

Once again, all Finnish originations came in D-rated loans, which had a slightly higher interest rate at 18.9%. In Estonia, B-rated loans grew by 1.8% to €2,097,131. E-rated loans also grew to €494,108, increasing by 6.0% from January.

The interest rates on Estonian originations were higher across all rating categories:

- B-rated: +0.13%

- C-rated: +0.04%

- D-rated: +0.13%

- E-rated: +1.10%

- F-rated: +0.02%

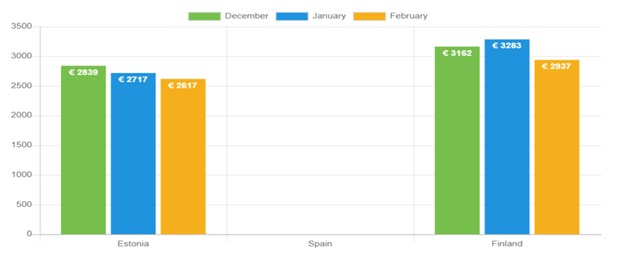

Loan amounts

The average Estonian origination fell for the third straight month, down to €2,617—a 3.7% decline from last month. Meanwhile, after growing for the past two months, the average Finnish loan receded in February. Finnish originations averaged €2,937 over the month—a decline of 10.5%.

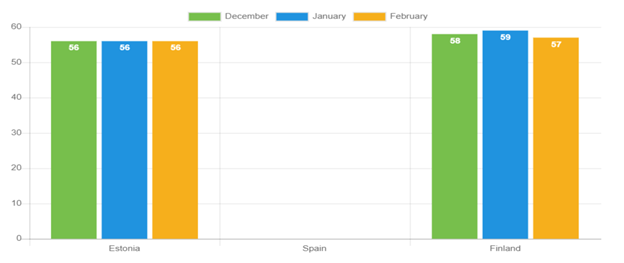

Loan duration

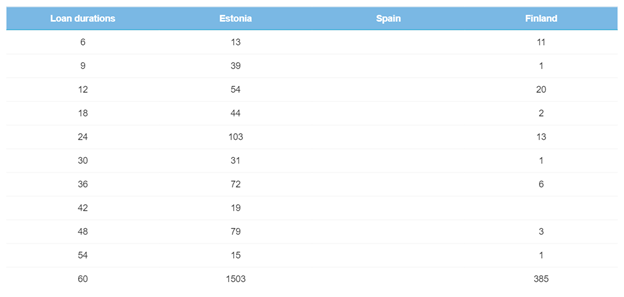

The most consistent aspect of Estonian loans throughout the past year has been their loan durations, and February maintained this trend. The average loan duration for Estonian loans stayed consistent at 56 months. Finnish originations saw their average loan duration fall from 59 months in January to 57 months in February.

The distribution of loan durations for Estonian originations was almost identical to the previous month. And while there were significantly more Finnish originations at 60 months (385 compared to 191 last month), this was offset by a rise in shorter-term originations, which also rose to more than offset this change.

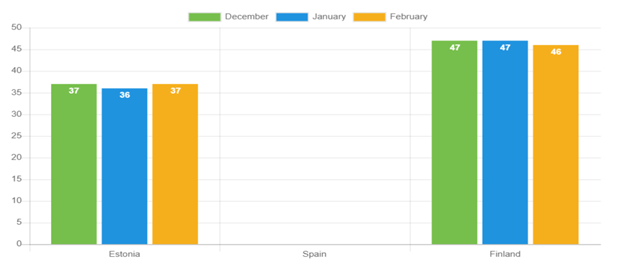

Average age

Estonian borrowers reverted to an average age of 37-years old, the same number as in December. In Finland, borrowers skewed down slightly lower to 46-years of age from 47-years the past several months.

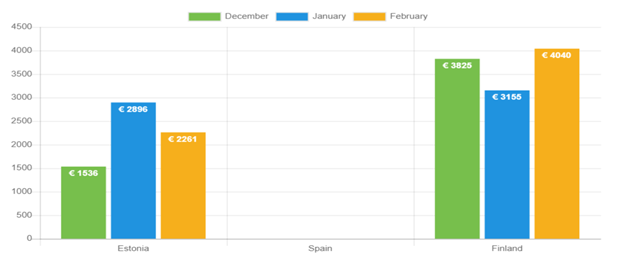

Income

Average incomes for Finland and Estonia went in opposite directions in February. Finnish borrowers averaged €4,040 In monthly income, up 28.1% from last month, and surging higher than the reported figure from December 2020. On the flipside, Estonian borrowers averaged 21.9% less income on the month, averaging €2,261.

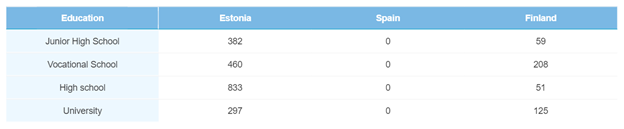

Education

Finland saw a rise in its borrowers with vocational school education, up from 41.8% to 47.0% of borrowers, while university-educated borrowers fell to 28.2% of Finnish borrowers. Ratios for Estonian borrowers’ education levels remained consistent with January. There was an increase in borrowers with a junior high school (382) and high school (833) education.

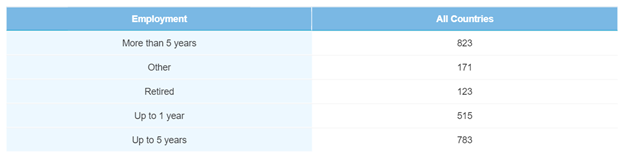

Employment

There was a significant shift in employment statistics for Bondora borrowers. Employment for more than 5 years exceeded all other categories, with 34.1% of all borrowers falling into this category compared to 32.3% last month. This was followed by 32.4% of borrowers who have been employed for up to 5 years.

Homeownership status

63.7% of Finnish borrowers were homeowners in February, followed by 25.7% of borrowers living as tenants. These categories were also the highest for Estonian borrowers, with 43.2% of such borrowers owning homes and 21.1% living as tenants.

Verification status

More Estonian borrowers were verified this month, with a ratio of 98.5% verification compared to 97.0% in January. Meanwhile, the Finnish verification rate fell slightly from a complete 100% to 99.5% in February.

Finnish originations continue growing

For the second consecutive month, Finnish originations bolstered Bondora, helping grow the platform’s origination as a whole by 4.5%. At the same time, interest rates for Estonian originations grew across the board. This is a positive sign for investors.

Learn more about Bondora investment products here.