For the dreamers

May was an exciting month for the Bondora team, with the final preparation work completed for the public release of our latest investment service Go & Grow. This has proved to be hugely popular so far, accounting for 24% of the total amount invested in the platform in May. As a result, our existing products Portfolio Manager and Portfolio Pro saw a significant reduction in popularity for the first time. At the end of May, Go & Grow had approximately 1,000 users with an average deposit size of €1,000.

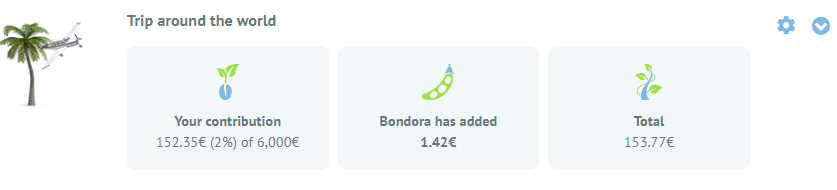

From the feedback received to date, our investors love to see interest added daily to their Go & Grow account. Within a short period of time, you can clearly see the progress you are making towards your goal and how much Bondora has contributed to your total pot (as shown in the image below).

Within the P2P community, there has been a huge investor demand for a product that gives them an impressive net return (6.75% p.a.*) whilst being simple and easy to manage. Go & Grow meets this demand for existing P2P investors and those who are completely new to the asset class. Another attractive feature of Go & Grow is the instant liquidity, meaning there’s no need for you to lock your cash away for years at a time or be restricted in your goals.

The demand for Go & Grow has already exceeded our expectations at Bondora even before it was officially released, we’re excited to see it grow throughout 2018.

Self-service

In May, we completed an update which allows investors to upload their identification documents through a seamless and secure option once logged in to their account. We’ve also changed some internal processes, which means your ID and bank account will be verified much quicker than previously and there’s no need to notify us via email.

Updates to our API

- Past scheduled cash flow – After the recent fractional ownership update, we had feedback from some of our API investors that it became difficult to analyse the payment accuracy of a loan, as the API only allows you to view the payment history and schedule for a particular loan part. We have now added the past scheduled cash flow to our public reports (named Loan Schedules) so you can analyse the data even further.

- Collection events – We had a request from an existing investor to make the events of the collection process available as a daily updated file, which can provide useful information for modelling purposes. We have now implemented this and you can find it available as a public file for all users (named DebtEvents), it contains the structure ReportAsOfEOD, LoanID, Event, Comment.

- Non-expiring token generation – We have added non-expiring token generation to the API. When generating a new token via the API, the new field non-expiring can be specified with value true or the non-expiring token can be generated from the API web page’s applications page.

* As with any investment, your capital is at risk and the investments are not guaranteed. The yield is up to 6.75%. Before deciding to invest, please review our risk statement or consult with a financial advisor if necessary.