Welcome to another post from our monthly funding statistics series. Here, we talk about the most popular investment methods used by our customers in June and how this has changed since the previous month.

The total amount invested through Bondora totalled nearly €5M in June, with slightly under €2M of this via Go & Grow.

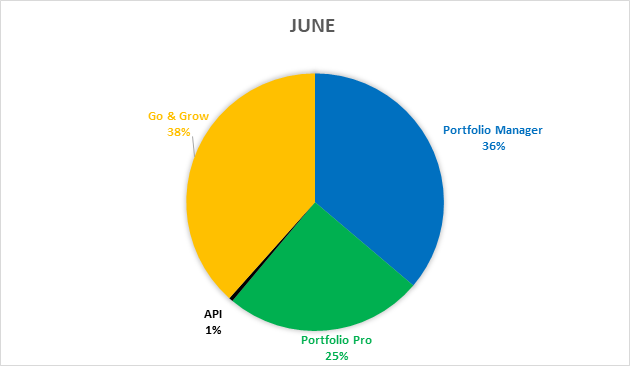

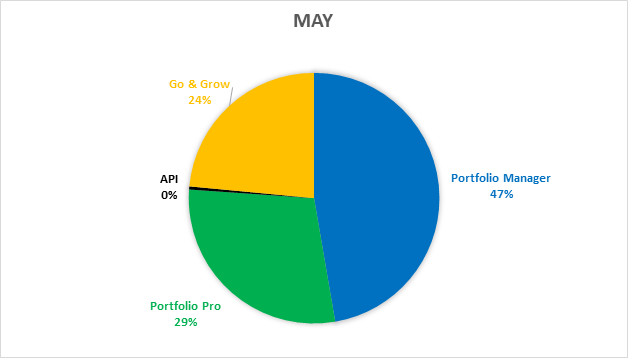

In line with the trend of previous month, Portfolio Pro and Portfolio Manager decreased in popularity in June thanks to the introduction of Bondora’s latest way to invest, Go & Grow. Now standing at 25% of the total investments, we saw a reduction of 4% for Portfolio Pro compared to the previous month. In line with this, Portfolio Manager’s share also decreased by a huge 11% and now accounts for 36% of the total.

Go & Grow is now leading the way at 38% of the total share – we expect to see this increase even further over the coming months. This is the first time Portfolio Manager has been overtaken by another service. In the beginning of June, Go & Grow was made available to all existing and new investors.

The percentage of investments made through the API increased slightly to 0.49% of the total (rounded figures in the pie charts) – due to the technical skills required for this option we do not expect to see this fluctuate widely on a monthly basis, as seen with the other investment options.

Look out for our upcoming post where we discuss where the highest percentage of investments have been made, breaking it down by country, risk rating and durations.

* * *

If you’re still unsure of the differences between each investment method, here’s a brief summary:

Go & Grow – Go & Grow is an incredibly simple and automated tool that allows you to earn 6.75%* p.a. on your investment and take your cash out at any time. This is for the people who want low risk and ‘no-hassle’ investing with a predictable net return. For now, this is not available to all investors however it will be available to all very soon. Find out more about Go & Grow.

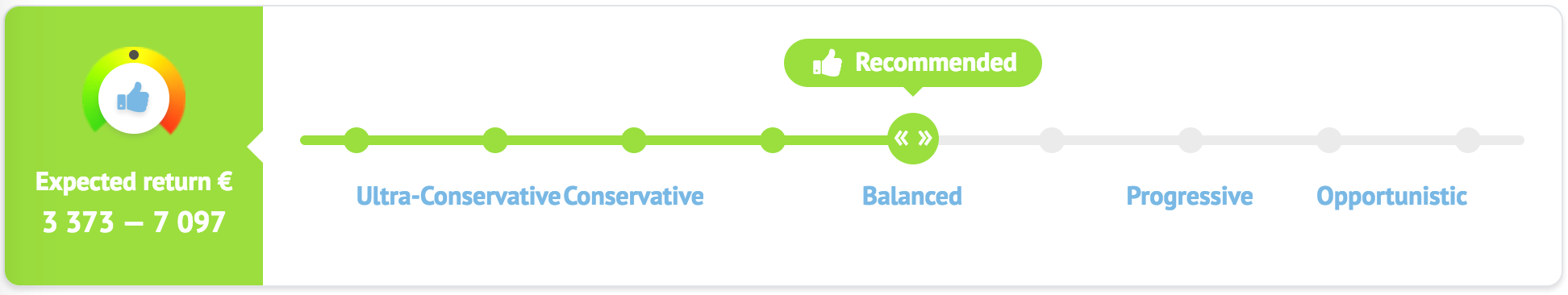

Portfolio Manager – Simply select a strategy ranging from ultra-conservative to opportunistic, deposit funds and you’re ready to go. No further management is required as the Portfolio Manager takes care of everything for you. If you want to leave a certain amount of cash on your account that won’t be invested, go in to your settings and adjust the Spare Cash Balance slider to your desired amount. It’s easy!

Portfolio Pro – Now you have more control. Select the risk ratings you want to invest in (ranging from AA – HR), select which countries, your preferred loan durations and it’s done. If you wish, you can also add a few more rules like the range of interest rates applied to the loan and also the bid size. We will then give you an expected return range along with the distribution you can expect across your selected filters.

For a further comparison between the two, check out our video on the topic here.

API – Use your programming skills to access the functionalities of the Bondora platform without using our web interface. The API gives you the ability to bid on specific loans by using different data points such as borrower’s income, country, loan status and many more that fit your personal investment strategy.

What is your favorite method? Let us know in the comments below.

* As with any investment, your capital is at risk and the investments are not guaranteed. The yield is up to 6.75%. Before deciding to invest, please review our risk statement or consult with a financial advisor if necessary.