While Bondora originated fewer loans in February compared to the previous month, not much has changed from the perspective of borrower profiles and lending status. Bondora has kept a consistent lending strategy for its borrowers and loan originations.

Lending Across Markets Remains Steady

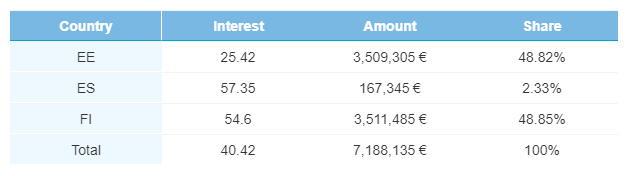

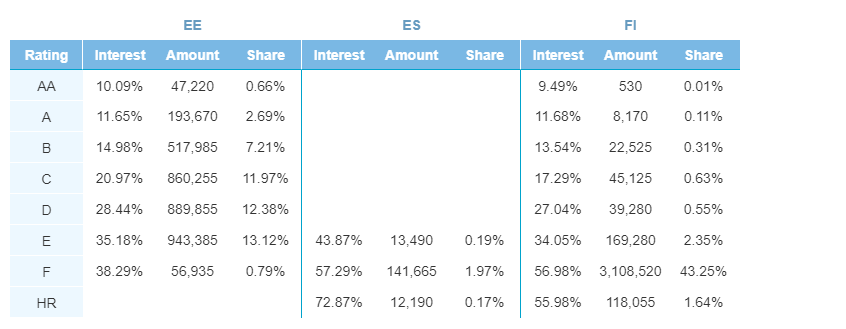

The percentage of loans across the locales where Bondora lends remained relatively stable in February. Loans in Estonia were up to 48.8%, taking 2% market share away from lending in Finland which was down to 48.9%. Lending in Spain remained almost exactly the same at 2.3% of the total lending share for the month.

Lending across rating and country as it relates to market share also remained constant. There were no major changes to note is it relates to lending across rating categories.

Average Loan Amount and Duration

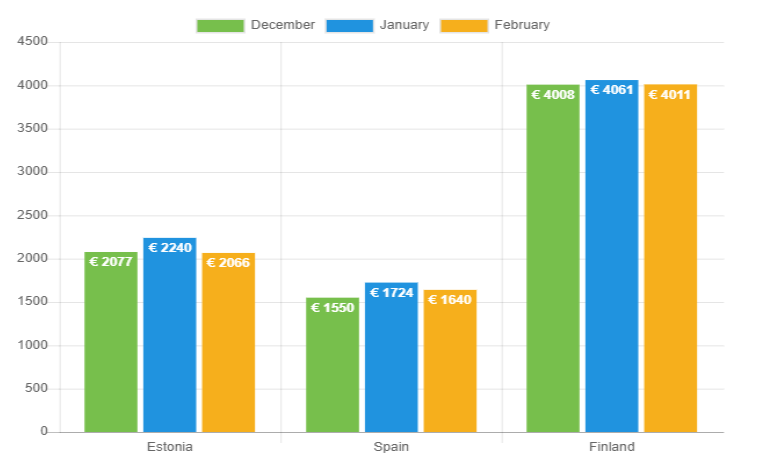

As expected, the average loan amount decreased in conjunction with the overall decrease in total lending on Bondora. Still, loan amounts were in-line with numbers seen in the past few months and the decreases experienced in February were not drastic by any means. The lowest decline in average loan amount was in Finland, where loans averaged €4,011 on the month, only down about 1.2%. The highest drop in average loan was in Estonia, which saw a 7.8% decrease in loan amount down to €2,066.

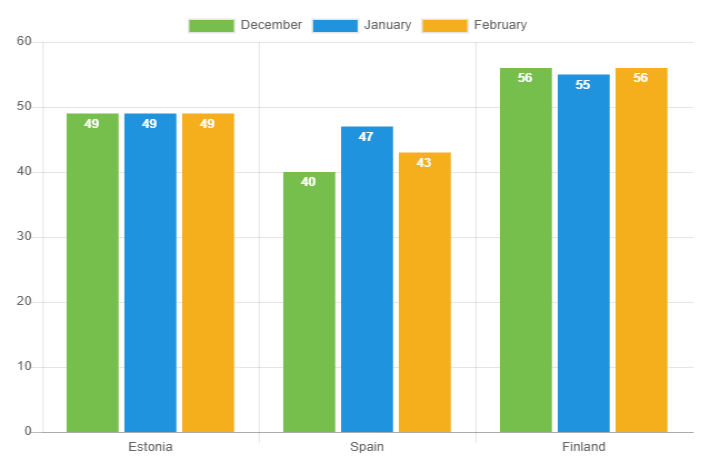

As for loan durations, numbers stayed consistent or across the board for Estonia and Finland. However, the average loan in Spain came to only 43 months, down from 47 months in January. This number is still higher than the 40 month average which from loans originated in December of last year.

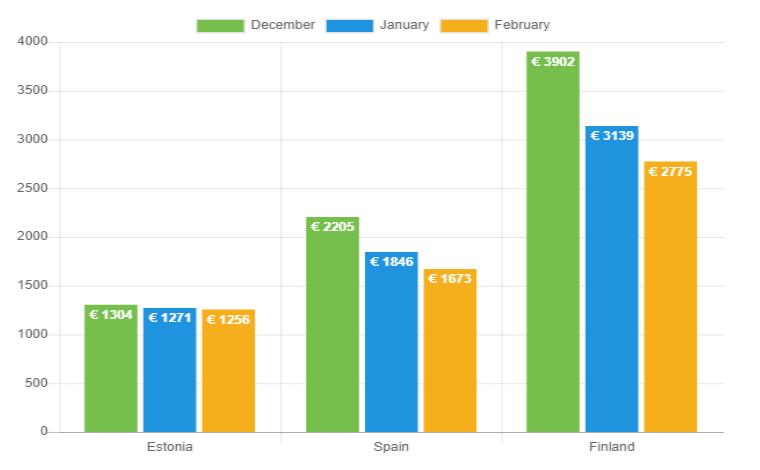

Net Income

Average net income for borrowers was down across the board. This is especially true for Finnish loans, where the average income per month for borrowers came in at €2,775, down from €3,139, or 11.6%, from January. Net income from Estonian borrowers was down, but only by a negligible amount, to €1,256 on the month.

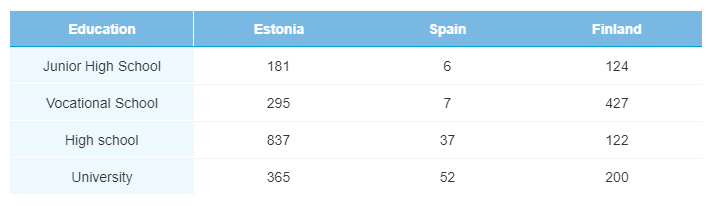

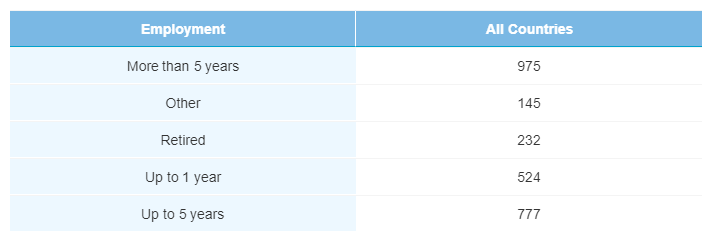

Education and Employment Duration

Even as the overall number of borrowers decreased on the month, more borrowers in Estonia were recorded with a university degree than in January. Overall, education levels in Estonia and Spain were fairly consistent with last month, with the majority of Finnish borrowers attaining a vocational degree.

Meanwhile, employment duration for borrowers displayed positive results. Of all Bondora borrowers, 66.0% have been employed for either up to 5 years or more than 5 years. This shows signs of employment stability among borrowers.

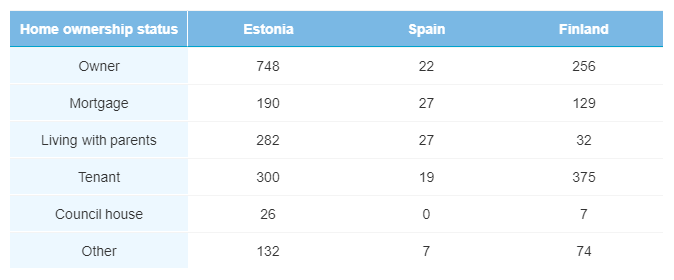

Home Ownership Status

Proportionally, Bondora borrowers in February displayed similar home ownership status as previous months. Once again in Finland the biggest category of borrowers are tenants at 43.0%, while in Estonia, more borrowers were homeowners (44.6%) than any other category.

Verification

The verification status of Bondora borrowers has remained constant. In Estonia, 45% are verified, while in Finland this figure stands at 70% and 87% in Spain.

Consistent Originations

The month of February resulted in lower loan originations as a whole by Bondora. Yet, the profile of loans which were originated and the borrowers behind them stayed in-line with previous month’s figures. Borrower information such as education, employment, and income was fairly consistent with previous months, as was lending amounts and durations.

It is great to know that no matter the amount of loans originated during any given month, Bondora has set high standards on its borrowers, and keeps a consistent lending model.

This provides investors with the security and stability they need to invest with confidence. This confidence is especially necessary for those investing in peer-to-peer loans for the first time. First time investors can take advantage of the simple and efficient Go & Grow investment service which provides an easy way to get started by automating the investing process.

Learn more about Bondora investment products here.