Choosing a Portfolio Manager strategy is the most critical decision a Bondora user will make. In this post we will look at the underlying characteristics of the various investment strategies, which range from “Ultra-Conservative” to “Opportunistic.”

Risk tolerance and expected loss rates

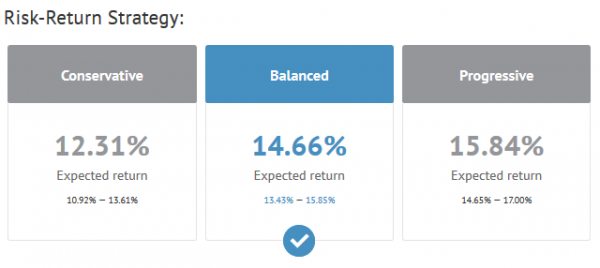

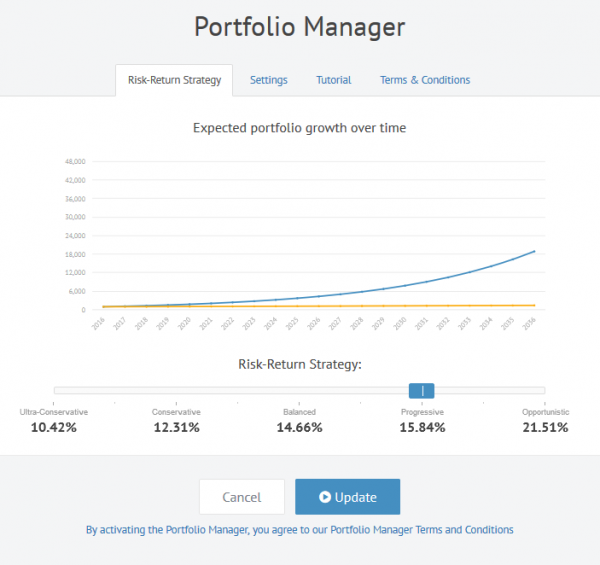

The Portfolio Manager page features three default settings, “Conservative,” “Balanced” and “Progressive.” However, investors can broaden their range of options with risk-return strategies including “Ultra-Conservative” and “Opportunistic.” These two additional options sit at either end of the risk spectrum.

Bondora uses your risk profile to choose the loans that form your portfolio. Investors who choose more conservative investment strategies are invested in loans with lower expected loss rates. Aggressive investors receive loans with higher expected loss rates. Over time the aggregate holdings in the portfolio match the risk tolerance of the investor. It is important for investors to monitor loss rates, payment statuses and the Bondora rating within their investments to ensure they are comfortable with the outcome of their Portfolio Manager settings.

Some investors engaging the “Conservative” setting may discover some HR loans in their portfolio. This can be unexpected because the HR rating is the lowest on our scale and therefore represents a high-risk investment. HR loans may become part of a conservative investment strategy when the current expected return of the portfolio is lower than the target expected return. In this case the Portfolio Manager might target loans with higher risk profile to achieve the required return.

Calculating expected return values

When choosing an investment strategy, users often consider the balance between their risk tolerance and their goal return rate. Bondora recalculates the expected return value for each strategy on a weekly basis. We run simulations using live and historical data. The combination of constant calculations and real data help us deliver realistic return values that represent achievable outcomes.

Understanding relative risk

Portfolio Manager settings like “Conservative” should be taken as a relative term. That is, a conservative approach within the Bondora setting is different than a “conservative” approach with other investment instruments. For example, an “Ultra-Conservative” strategy within the world of Bondora’s marketplace lending may carry greater risks than an “Ultra-Conservative” stock or bond strategy because the investments are not comparable and represent entirely different types of risk.

[…] can choose from a variety of risk tolerances when using the Portfolio Manager. However, in a recent post we discussed the importance of monitoring your portfolio even after making this selection. Taking […]

[…] Manager is adhering to the investment style the user selects. As we have explained in previous posts, terms like “conservative” and “aggressive” are not comparable to other investment […]