In April, Bondora origination statistics pointed to a strong peer-to-peer lending market for investors. During May, these figures were solidified, as almost all trends in Bondora loans over the month held steady, with all signs pointing towards a stable lending market.

Country Breakdown

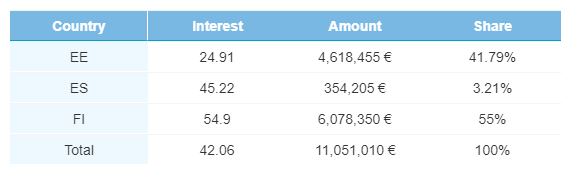

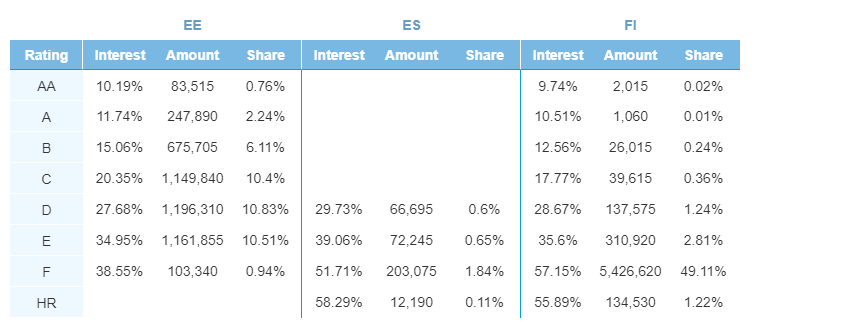

Loan originations were almost identical to April, totaling €11,051,010, up by 0.4% compared to last month. Originations out of Estonia dropped by 2.53% to 41.79% of the total share of Bondora loans. Alternatively, Finnish loans rose in total share from 53.9% to 55%.

The majority of the increase in Finnish loans came in F rated loans out of the country, which garnered 49.1% of all Bondora loans on the month. The only other loan categories to hold a double-digit share of all loans were C, D, and E rated loans from Estonia. All other loan categories failed to hold a significant share of Bondora loans on the month.

Increasing Loan Amounts and Durations

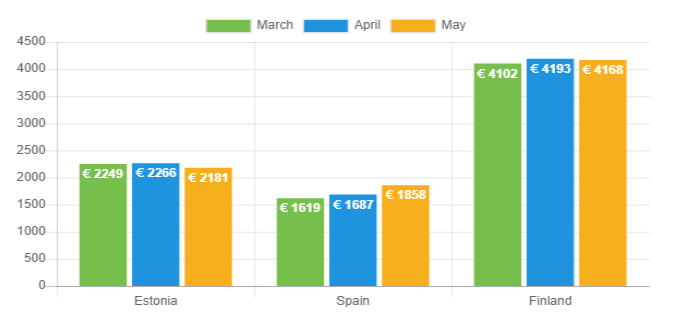

In Spain, the average loan amounts rose considerably, up by 10.1% to €1,858. Meanwhile, average loans in Finland and Estonia dropped, to €4,168 and €2,181 respectively.

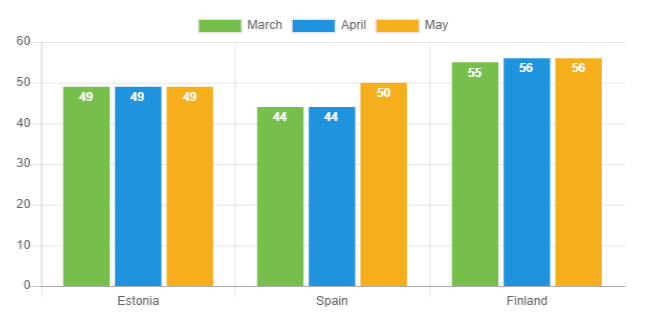

Higher loan amounts in Spain also correlated with longer average loan durations. The average loan duration in Spain was 50 months in May compared to 44 months in April. Loan durations in Estonia and Finland were both on par with averages from last month.

Stronger Finnish Borrowers

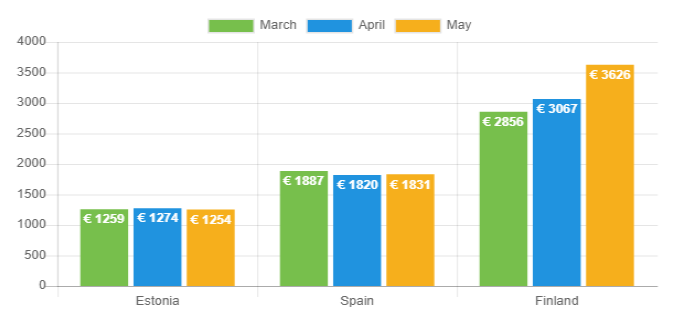

A borrower’s income is one of the many key indicators we assess before issuing a loan. In May, Bondora issued loans to borrowers in Finland who earned significantly more income than previous months. The average monthly income for borrowers out of Finland was up a solid 18.2%, to €3,626. Incomes of Spanish and Estonian borrowers were relatively similar to previous months.

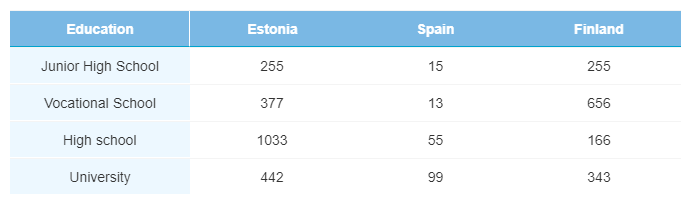

Trends in educational statistics for Bondora borrowers remained constant over the month. The majority of Estonian borrowers have a high school education, while the biggest sub-set of Finnish borrowers have a vocational school education.

Employment

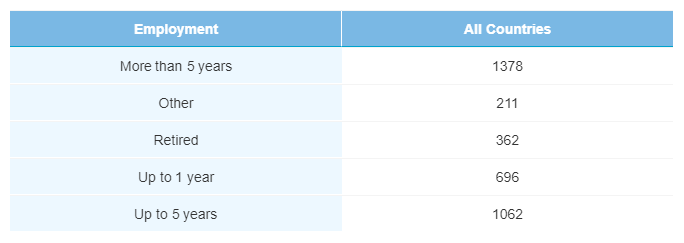

Bondora borrowers maintained their level of employment in May, with an identical ratio of borrowers who have been employed for up to 5-years or more than 50-years (65.8%).

Home Ownership Status

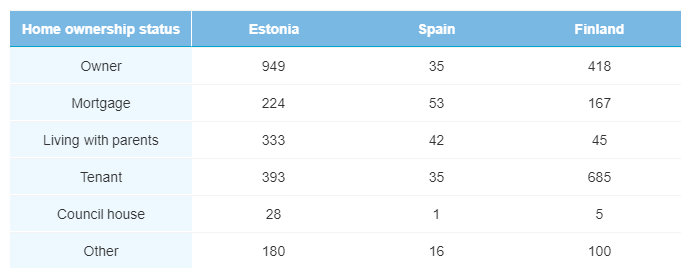

Home ownership trends were continued in May. In Estonia, ‘Owner’ is most common (45.0% of all borrowers), while in Finland more borrowers are tenants (48.2% of all borrowers). These figures were slightly higher than in April.

Verification Status

Slightly more Estonian borrowers were verified in May, with 43.5% of total borrowers in the country going through the verification process. 69.4% of Finnish borrowers were verified in May, in-line with the previous month. While there are significantly less borrowers in Spain, they are much more likely to be verified, with 88.7% of all borrowers from Spain verified.

Origination Stability

Origination trends and data in May were almost identical to figures in April in many different categories. This points to a stable peer-to-peer lending market in which Bondora has found its place. The biggest positive from the month was the drastic increase in average income from Finnish borrowers, who, with higher regular incomes, are more likely to make loan payments in a timely manner.