It would be pretty awesome if we had as much money as we wanted to invest here on Bondora and everywhere else that we could possibly invest.

The reality is that we all have limited funds to work with. We need to choose our loans wisely, use our money effectively and reduce cash drag from non-invested funds to as little as possible.

We try and help you invest more effectively with two different features: Pending Offers and Reserved Funds. What are they and how do they work?

Pending Offers

Every offer made on a loan is a Pending Offer. When you as investor make a bid on a loan, it is listed as “Pending”.

We do this because we do not lock up your funds to a certain loan before the loan sale process is initiated. The result is that every bid is a non-binding (on you) bid and shown as a “Pending Offer”.

This is more effective for you as you can make sure your money moves into loans that fund faster putting more of your money to work sooner. And you can bid on as many loans as you want.

Since each bid is non-binding, they can be cancelled at anytime from Pending Offer stage. You can review your current Pending Offers from the Dashboard. Just go from Dashboard > More Stats > Pending Offers.

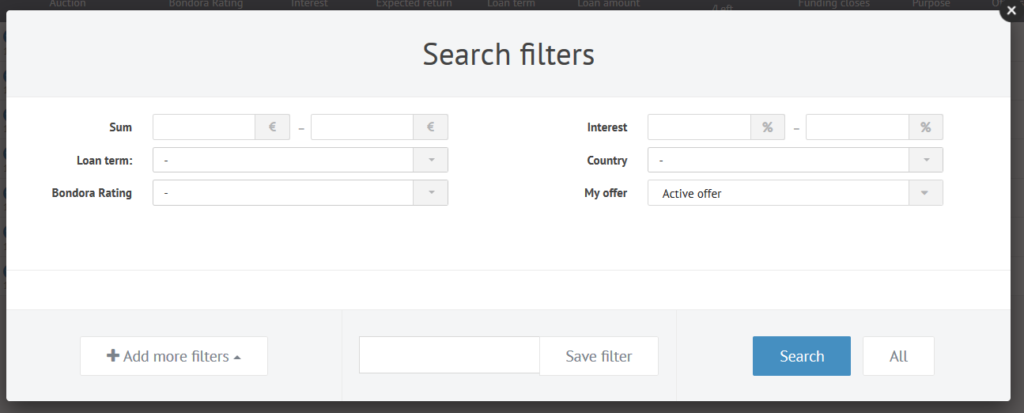

You can also cancel a bid manually directly from the Market if you need to. From the Market page, you can use the filter My Offer > Active Offer from search filters (at the top right).

Remember, every offer is a Pending offer until the loan sale process is initiated. Once the loan process is initiated you can no longer cancel from it.

Reserved Funds

So now that we understand that every offer is a Pending Offer, what are Reserved Funds?

Once the loan sale process is initiated, our system goes through all the bids taking into account the time the bid was made and the amount of the bid. Some loans have too many bidders. At this time we are searching to see that your account has enough funds in it to fulfill the bid you made. Then our system reserves the funds from the investors with the winning offers to execute the sale.

Reserved Funds means the system has taken those funds and locked them down to execute the sale. It means very soon the loan will be acquired. And with your money.

When you make a bid on a loan you have a Pending Offer, every time. When the loan sale process starts and if your funds are going to be used to buy part of that loan (a winning bid), your bid moves from Pending Offer to Reserved Funds. Those funds are then converted into the investment you have made into your loan of choice.

What happens to bids when The Portfolio Manager is paused?

The Portfolio Manager helps you make bids more effectively, but you may not have it on all the time or may pause it from time to time.

What happens to your bids then?

If the Portfolio Manager is on pause, it will not make any new bids for you. That part of it stops.

You should note that bids that were made while your Portfolio Manager was active are still active. They are not called back due to you pausing the Portfolio Manager. Bids made from when the Portfolio Manager was active can still turn into investments when the Auction ends by going from Pending to Reserved to Funded.

If your goal is to pull back some of your cash then you need to pause the Portfolio Manager and go in manually and cancel some of your bids.