Last week we walked through our servicing, collection and recovery process. Today we will demonstrate the performance of the recovery process across different countries.

KEY TAKEAWAYS

- Recovery rate in Estonia has averaged around 50 per cent under the current process. Legal litigation has recently been combined into the process to further boost recoveries.

- Recovery rate in Finland averages around 30 per cent and similarly to Estonia has been relative stable. Legal litigation will replace the current process in August as the recovery rates were higher under the old process.

- Recovery rate in Spain has remained at around 45 per cent during the current process and is close to the performance in Estonia. Legal litigation will also be used in the future in a combined process to deliver highest possible recoveries.

PRINCIPAL RECOVERY RATES ACROSS MARKETS

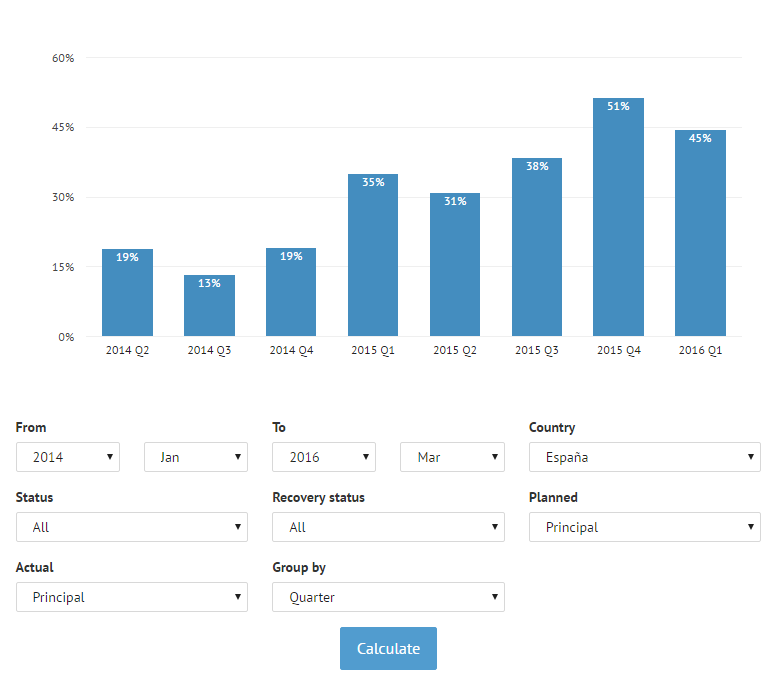

Below you can see the recovery rates across markets per quarterly cohorts. The cohorts are made of loans that defaulted in that particular quarter. Debt collection agencies have been used since 2015 Q3.

| Quarter | 2014 Q1 | 2014 Q2 | 2014 Q3 | 2014 Q4 | 2015 Q1 | 2015 Q2 | 2015 Q3 | 2015 Q4 | 2016 Q1 |

|---|---|---|---|---|---|---|---|---|---|

| 56% | 76% | 79% | 81% | 125% | 96% | 45% | 55% | 54% | |

| 39% | 53% | 32% | 56% | 77% | 87% | 26% | 28% | 39% | |

| N/A | 19% | 13% | 19% | 35% | 31% | 38% | 51% | 45% |

ESTONIA:

- Recovery rate in Estonia has averaged around 50 per cent under the current process.

- The recovery rate was approximately 20 percentage points higher when legal arbitration was used. This practice was stopped due to regulatory changes effective from July 2015.

- Legal cases are now being filed against loans that have gone through debt collection agents. Old cases are expected to be filed by end of the summer and thereafter it will be an on-going process. Therefore we expect the performance of the combined process to further increase recovery rates in the future.

FINLAND:

- Recovery rate in Finland averages around 30 per cent and similarly to Estonia has been relative stable.

- The recovery rate varied between 30 and 90 per cent when local courts were used.

- Legal litigation in Finland will be started automatically when loan defaults as we have now developed an API to process the legal cases. The technology will be rolled out over the next month and thereafter all old cases will be filed and new cases will be filed automatically. Debt collection agencies will not be used post default.

SPAIN:

- Recovery rate in Spain has remained at around 45 per cent during the current process and is close to the performance in Estonia.

- The recovery rates were on average twice lower when using European Payment Order legal process.

- Local legal litigation will be started in Spain for cases that have gone through debt collection agents. We expect to file the cases during August and thereafter set up a recurring process. The combined process, according to local market data, is expected to be close to levels achievable in Estonia and Finland.

HOW ARE RECOVERY RATES MEASURED?

We calculate the recovery rate by comparing actual principal cash flow (net of write-offs) that occurred after the default with principal cash flow that we would have expected from the loan in case it had paid according to the agreed schedule. This measure allows us to determine the expected capital loss on loans that default.

Data is aggregated to larger cohorts and recent data are excluded as otherwise outliers will skew the results too much (e.g. 1 customer repaying the full amount after default at once). On the Bondora level this means excluding the last three months of defaults and using country based quarterly cohorts. Data on individual portfolios should likely be viewed on a higher level either using yearly country based cohorts or simply quarterly cohorts across all countries.

HOW TO FIND RECOVERY RATES USING BONDORA STATISTICS?

You can easily find information on recovery rates on the entire Bondora portfolio through the Recovery Rate chart on Public Statistics. The same chart is also available for the portfolio of each individual investor in your Personal Statistics page. Simply adjust the period, country, planned, actual and group by filters to pull out the numbers shown above.

Some tips to help you master the Recovery rate chart:

- The period filter looks for loans that defaulted in the specific time range.

- The country filter allows to look at defaults from a specific country

- The status filter segments the data based on the loans current status (Defaulted = loan is still in default; Full recovered = the loan has been repaid in full; Restructured = a new payment schedule has been agreed; Sold = loans you have sold – this is only applicable to your private portfolio)

- The recovery status filter allows you to analyze the performance based on the latest high-level collection and recovery stage assigned to the loan

- Planned and actual filters make it possible to determine how the recovery rate is calculated. You can for example compare planned interest vs. actual interest received or planned principal vs. actual principal received.

HOW CAN I USE THE RECOVERY RATE?

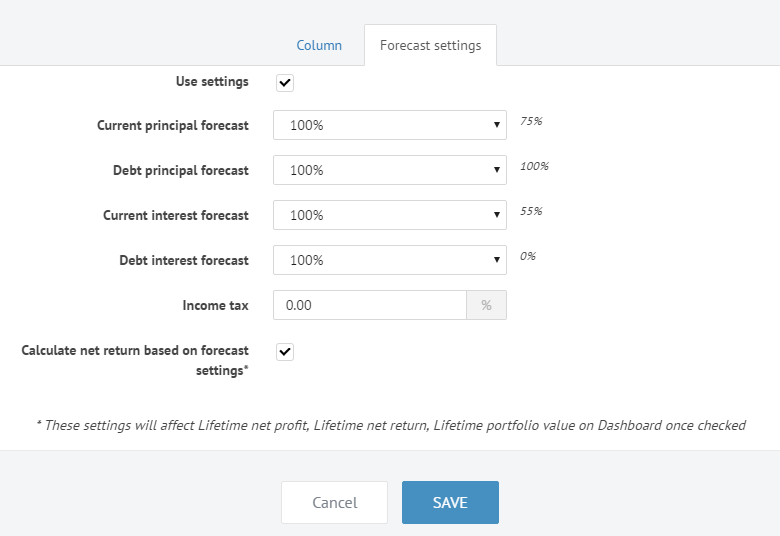

The recovery rate helps you understand how much of the principal balance of loans in default you are likely going to receive. This figure can be used to adjust future cash flows and arrive at a risk-adjusted yield-to-maturity of your Bondora portfolio. You can do this for your portfolio through the Cash Flow page Settings section. The Forecast settings provide you recommended ratios calculated on your portfolio historic cash flow that can be used instead of taking them from recovery rate charts.

WHY DON’T YOU CALCULATE THE RECOVERY RATE ON THE PRINCIPAL BALANCE?

Some customers have criticized the recovery rate calculation stating that a borrower who defaults is liable to return the principal balance at once. This criticism is valid from a legal perspective but not from a financial. The right to demand immediate payment of the principal balance is stipulated in the agreements to make enforcing the contract economic. The cost of collection and recovery would be excessive if enforcement steps would need to be taken for each missed payment. This clause makes it possible to substantially reduce the number of steps necessary to enforce the contract and get the borrower to start making payments under the agreed schedule.

The right to demand immediate payment of the principal balance does not mean it is reasonable to expect this to happen. Consumers take out loans to pay for larger purchases in affordable monthly payments. Loans would not be required nor interest paid on them if people would have the capital available themselves. Borrowers having financial difficulties are even less likely to have this sort of capital available. Therefore the main objective of collection and recovery is to restore the cash flow, or part of it. The success of these activities are measured by looking how much of the cash flow was restored.