Return rates for the Bondora originations portfolio turned in a great August, with return rates growing once again to exceed the previous month. Investors will be quite pleased with the returns generated from the Bondora platform in August.

Key statistics

- August yearly returns for 2021 were 0.4% higher than in July

- 2021 Q2 returns were higher by 1.5%

- Estonian originations had higher returns across the board for the most recent quarter (2021 Q2)

- Spanish originations had lower returns across the board for its most recent quarter (2021 Q1)

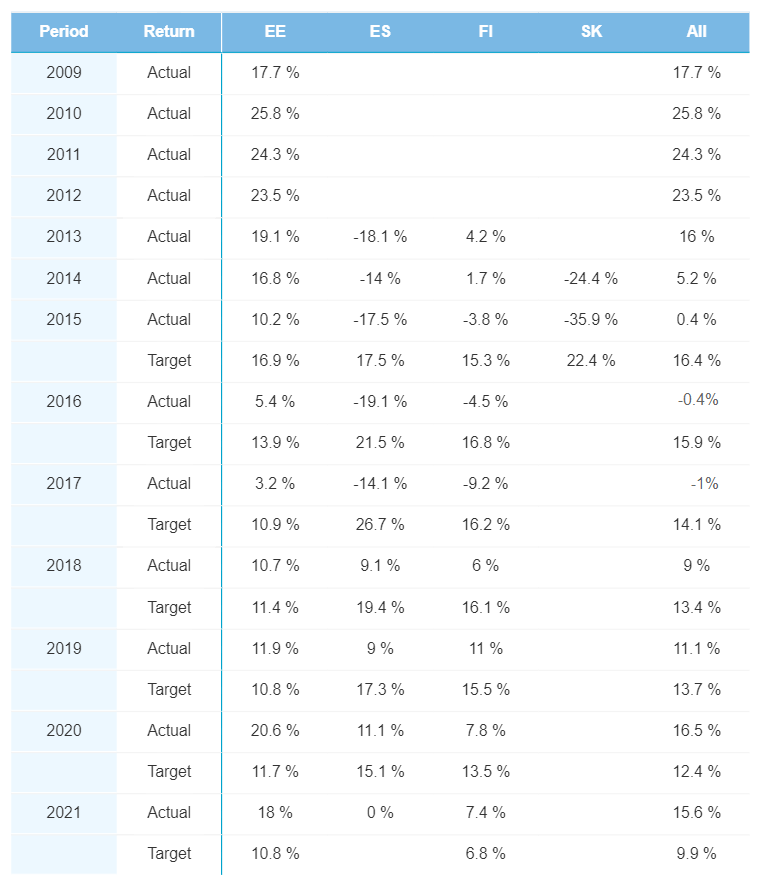

Yearly performance

There was a surprisingly positive jump in returns for the Bondora originations portfolio. In August, the cumulative return rate for 2021 originations came to 15.6%—a 0.4% jump from the previous month. This return rate was also 5.7% higher than the target rate for 2021. Finnish originations returned 0.7% higher, while Estonian originations grew by 0.5%.

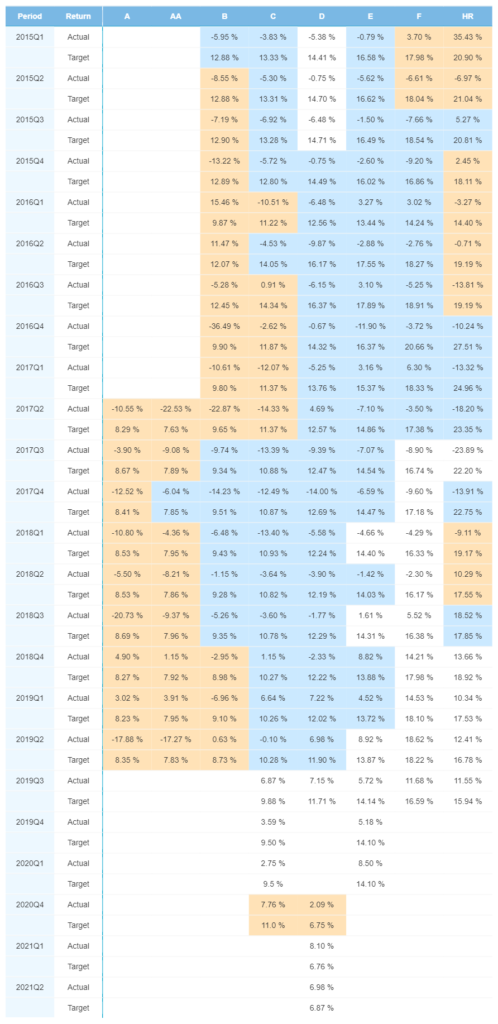

Quarterly performance

Returns for the most recent quarter were solid this month. 2021 Q2 returns were higher by 1.5%, up to 14.1%. The previous quarter, 2021 Q1, was also slightly higher, up to 17.0%. Meanwhile, the return rate for 2020 Q1 originations fell to its target rate of 12.8%.

Finland

The lone Finnish origination category—D-rated loans—performed well, coming in 1.1% higher for the most recent quarter and 0.3% higher for the prior quarter. Interestingly, 2020 Q4 returns were higher in both D-rated originations (up 0.3%) and C-rated originations (up 0.1%).

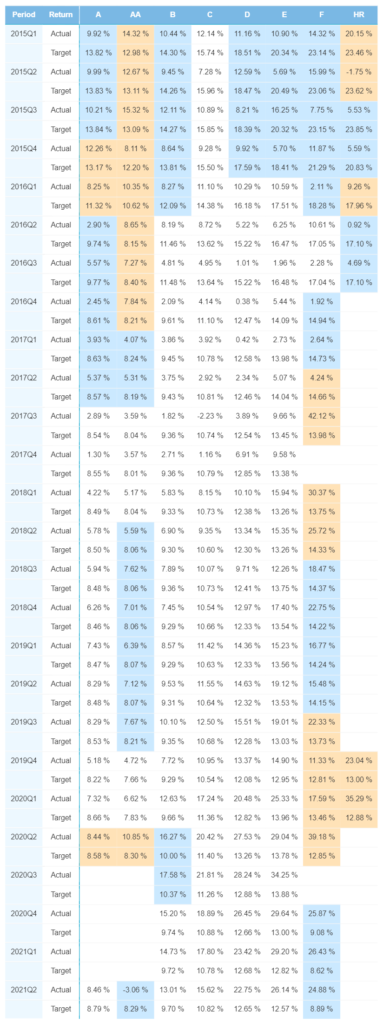

Estonia

2021 Q2 Estonian originations showed significant strength this month. All origination categories returns were higher across the board:

- A-rated: +3.2%

- AA-rated: +10.0%

- B-rated: +1.1%

- C-rated: +1.5%

- D-rated: +2.0%

- E-rated: +1.8%

- F-rated: +1.9%

Spain

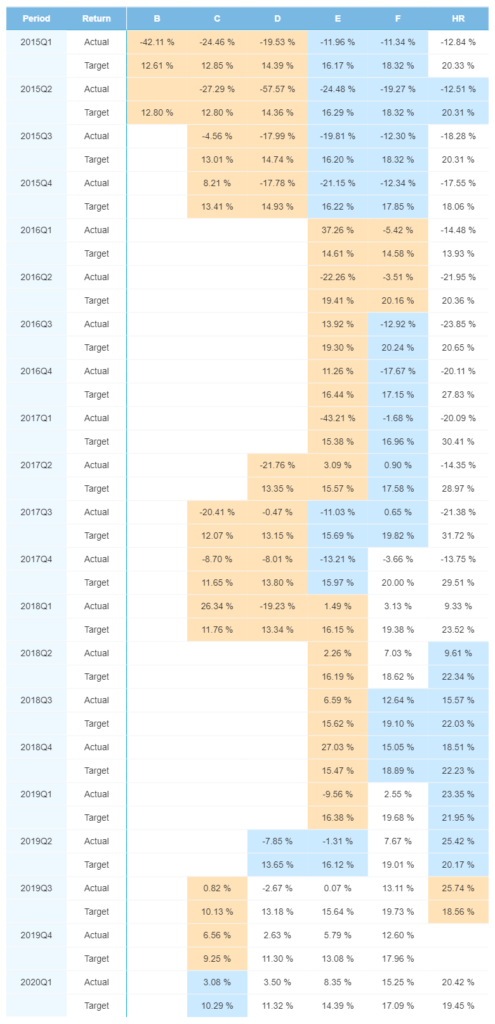

Unlike Estonian originations, Spanish originations went the complete opposite direction and were lower in all categories for their most recent quarter (2020 Q1):

- C-rated: -0.7%

- D-rated: -0.6%

- E-rated: -0.8%

- F-rated: -0.9%

- HR-rated: -0.8%

Conclusion

Bondora investors will be happy about the higher return rates for 2021 originations. The 0.4% month-over-month growth rate was solid. Estonian originations led the way, growing across all rating categories. Estonian AA-rated originations led the pack as they were 10% higher than the previous month. Meanwhile, returns for Spanish originations lagged. Although this is not an apples-to-apples comparison, as the most recent quarter for Spanish originations was back in Q1 2020.