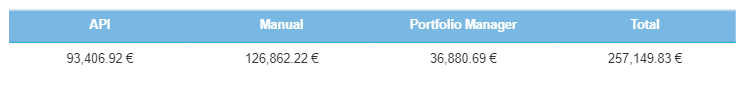

After two months of declining, Secondary Market activity picked up again, albeit with a very slight 2%. A total of €257,149’s worth of transactions took place in November, compared to €252,126 in October. It might look similar to last month, but there were a lot of changes underneath the surface. Take a look:

API and Portfolio Manager transactions increased, but Manual transactions declined by 17.0%. Portfolio Manager’s growth was the most impressive, with a 99.0% increase, while the API gradually increased 15.6%. Portfolio Manager still has the highest value, totaling €36,880 in transactions.

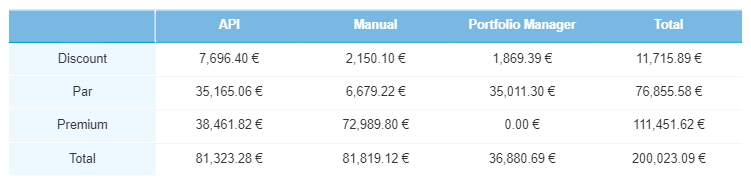

Current loans

Current loan transactions took the bulk of all transactions, coming in at €200,023. The API and Manual transactions took an almost equal split of 40.7% and 40.9%, respectively, while Portfolio Manager took an 18.4% share of all current loan transactions. Transactions done at a premium were by far the most popular in November, making up 55.7% of all transactions.

Overdue loans

In October, Secondary Market overdue loan transactions totaled €23,960, down 43.7% from the previous month. This was primarily due to a decline in loans transacted at a discount, which were 78.3% lower. Contrary to the rest of the overdue loan transaction categories, API transactions were higher, up from €6,069 to €7,701.

Secondary Market overdue loan transactions totaled €25,415, up 6.0% from October. Loans at a discount and at par increased, while loans at a premium declined. Overall, API transactions increased, while manual transactions declined slightly.

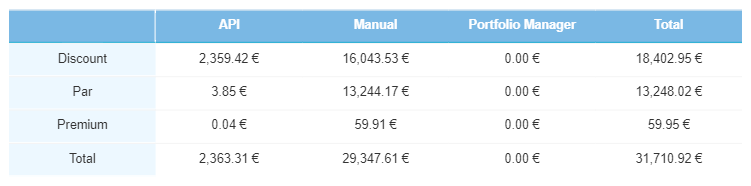

Defaulted loans

Defaulted loan transactions increased by 2.4% to €31,710. In contrast to October (when there were almost no defaulted loans purchased at par value), in November, almost half of all transactions were done at par value (€13,248). Manual transactions increased by 7.4%, while API transactions dipped by 35%.

Slight increases in November

Activity on the Secondary Market rebounded ever so slightly after two months of decline. Even though the API has shown a considerable increase in activity these past few months, Manual transactions remain the most active segment. Loans at premium had a month in the spotlight, so we’ll have to see whether this trend will continue in December.

Remember, investors should not seek higher returns from buying and selling loans on the Bondora secondary market.