The Bondora Secondary Market had a complete trend reversal in August. There was an astronomical 107.9% growth compared to July. This equates to a total of €338,235 being transacted on the Secondary Market.

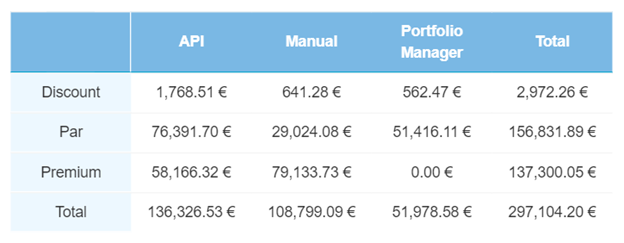

The most significant growth factor, by far, was a 1,139.3% increase in Portfolio Manager transactions, which totaled €51,978. API transactions also increased in a sizable way, up to €148,949, a 169.4% increase from July. As a result, API transactions overtook Manual transactions as the most-used investment product on the Secondary Market. Manual transactions also were higher on the month, up 33.0%.

Current loans

Investors opted to pay a premium for Bondora current loans on the Secondary Market. There was a 35.5% increase in premium current loan transactions and a 546.6% increase in transactions at par value.

Overdue loans

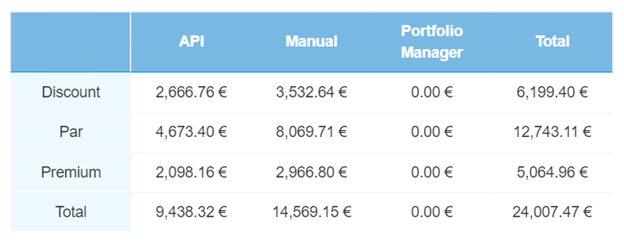

Transactions of overdue loans were higher in August, but not as significant as the overall increase in Secondary Market transactions. A total of €24,007 in overdue loans was transacted—a 23.9% increase month-over-month. The biggest increase came from transactions at par value, which was higher by 141.4% to €12,743.

Defaulted loans

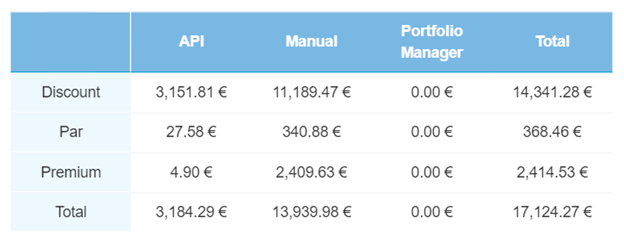

A total of €17,124 defaulted loans was transacted in August, up by 22.6% from July. Interestingly, investors transacted €2,414 for defaulted loans at a premium, an enormous 1,311.7% increase from the previous month.

Investors charged back to the Secondary Market

The Bondora Secondary Market had experienced a steady decline in transactions for several months as investors gravitated toward the steady and hands-off investing of Go & Grow. However, August saw a complete trend reversal, with a 107.9% increase in total Secondary Market transactions. At €148,949, API transactions were the most popular. Meanwhile, Portfolio Manager transactions increased by 1,139.3%, leading to the revival of the Secondary Market.

Remember, investors should not seek higher returns from buying and selling loans on the Bondora Secondary Market.

You can learn more about the Bondora Secondary Market here.