Return rates for 2021 Bondora originations continue to perform well in November, as they did in October. Spanish originations continue to rise above the target rate for 2021, along with other rates for the last two years. Overall, it was a steady month with a promising end to the year lying ahead of us.

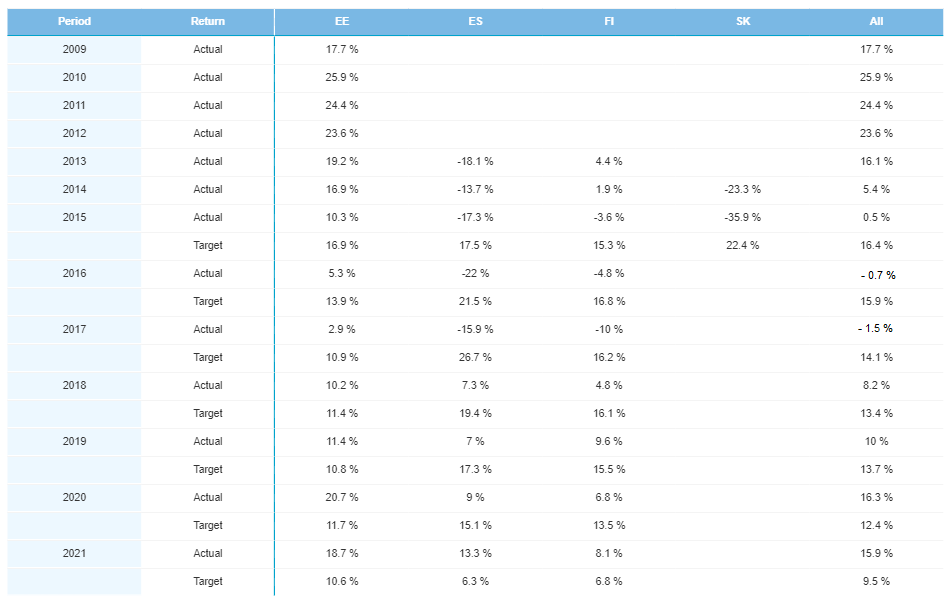

Yearly performance

All the return rates for 2021 originations were higher in November. The cumulative return rate is now 15.9%, which is 0.1% higher than last month, and 6.4% above target. The Spanish origination rate continued to climb drastically, up to 13.3% from 6.9% in October. This is thanks to the relaunch of the Spanish market.

Things also fared well for 2021 originations closer to home; Estonian originations increased by 0.1% and Finnish originations by 0.2%. As they did in October, 2020 originations returned slightly lower at 16.3% compared to 16.5% last month.

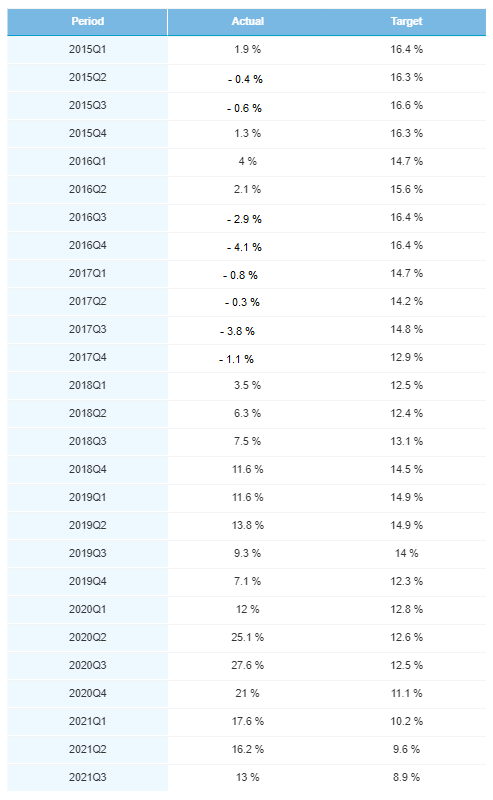

Quarterly performance

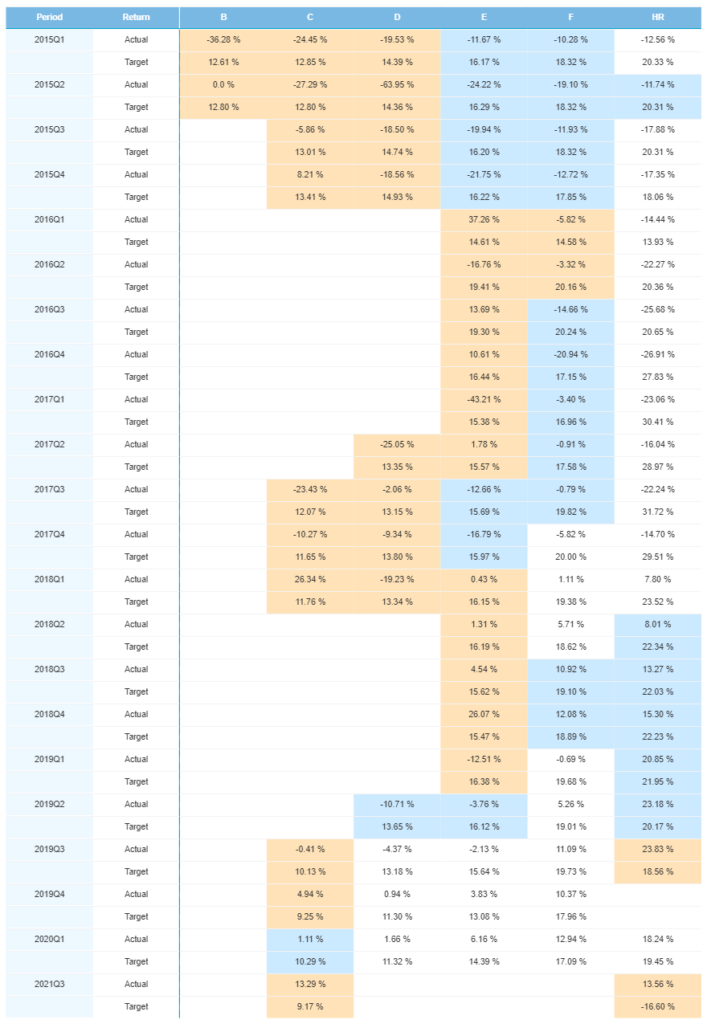

Here’s a quick overview of how returns for all three quarters of 2021 performed in November:

- 2021 Q1: -0.1%

- 2021 Q2: +0.1%

- 2021 Q3: +1.2%

Every quarter from 2020 Q2 is very competitive compared to their target rates. 2020 Q3 still has the highest return rate over the past several years with 27.6% vs. a target rate of 12.5%.

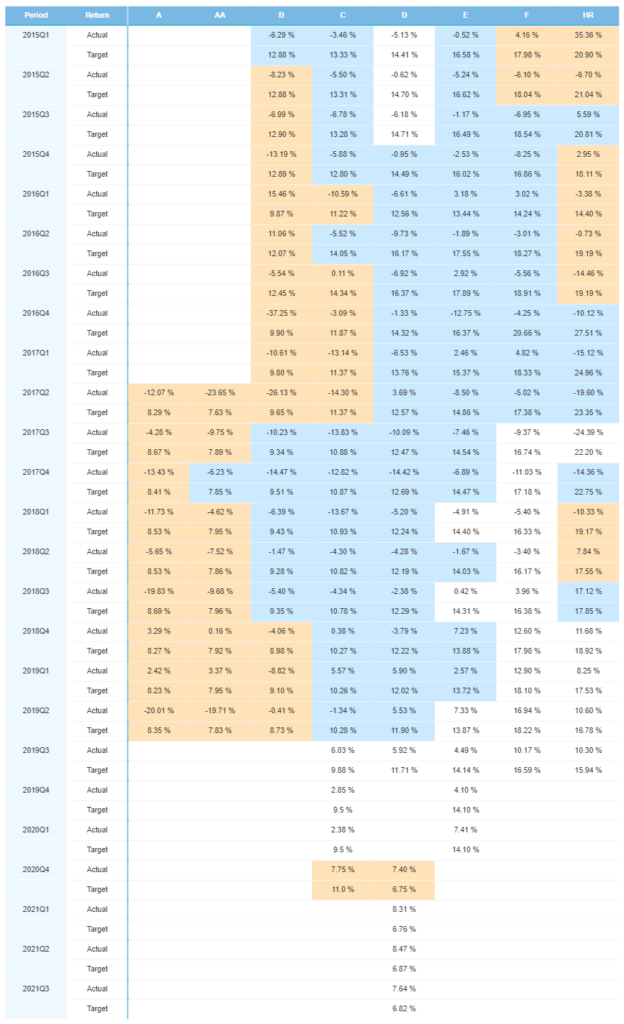

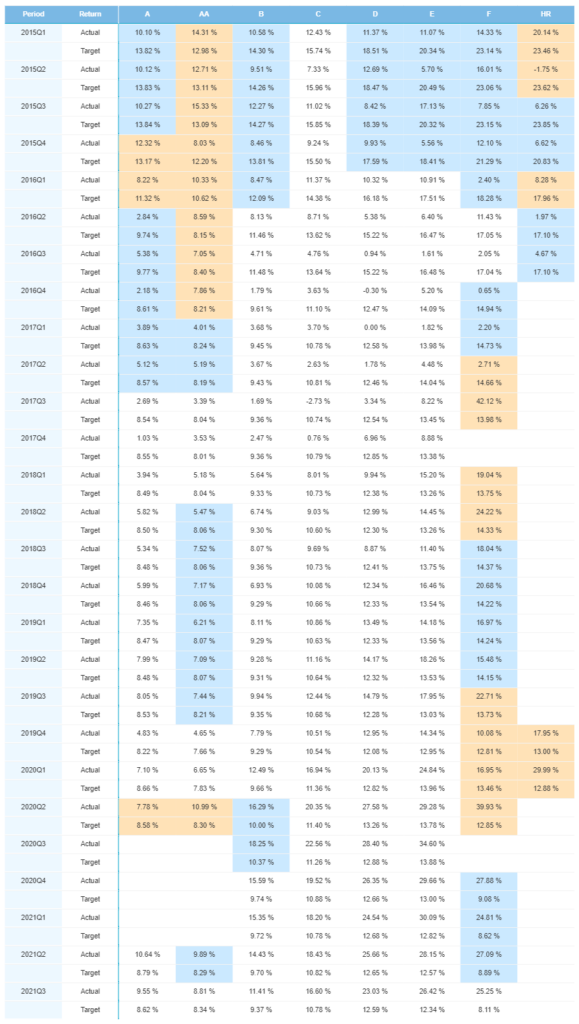

Finland

Finnish origination rates for the last four quarters are above their target rates. Finnish returns for 2021 Q3 jumped 0.8% to 7.6%. More risk-rating categories were relaunched in Finland in Q4, so it will be interesting to see how they will perform this quarter.

Estonia

In Estonia, all seven risk-rating categories are above target from 2020 Q3 to 2021 Q3. This is an excellent feat. Here’s a quick overview of how all seven originating categories for 2021 Q3 increased in November:

- A: +0.8%

- AA: +0.8%

- B: +1.2%

- C: +1.5%

- D: +2.0%

- E: +2.1%

- F: +2.3%

Spain

Spanish originations for 2021 Q3 continue to look fantastic and perform above target. After growing from 0% last month, 2021 Q3 Spanish originations are excelling at 13.3% for C-rated loans and 13.6% for HR-rated loans. However, as was the case last month, 2020 Q1 originations are far below target.

Conclusion

November was another excellent month for Bondora’s portfolio performance, albeit very similar to last month’s. 2021 origination returns overall rose by 0.1%. This is a marginal increase, but Spanish loans showed their strengths after relaunching and exploded in growth. Estonian returns were higher across the board for all origination rating categories. And the most recent quarter, 2021 Q3, is performing well above target.