Bondora loan originations in June decreased compared to the previous month. Statistics in borrower behavior and profile were mixed, with trends being dependent on the origination country. Overall, we saw an increase in Spanish loan originations and a comparable decrease in Finland.

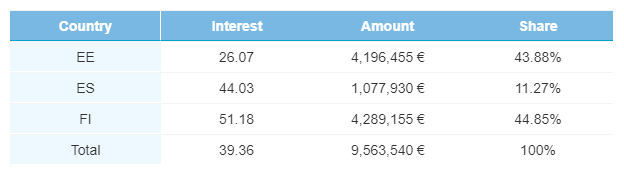

Country Breakdown

Originations in June saw a reduction of 13.5%, down to €9,563,540. Finland had the biggest change, falling to €4,289,155 (10.2%) in total share to 44.9% of all originations. Originations in Spain rose to some of their highest levels this year, garnering 11.3% of total originations, or, €1,077,930.

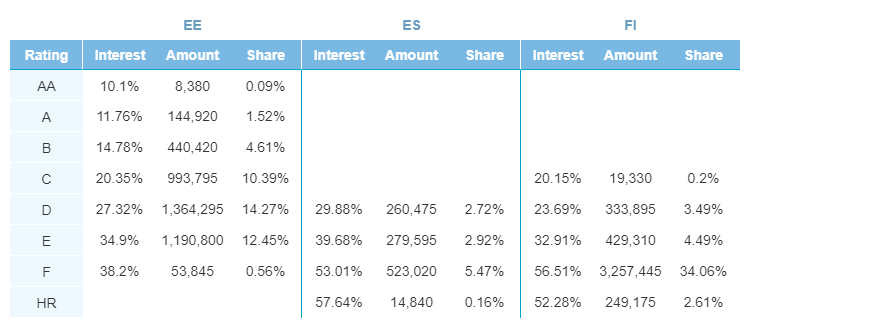

The biggest jump was in Spanish F rated loans, which accounted for almost half of all Spanish originations at €523,020. D rated loans out of Estonia were higher by €167,985 to €1,364,295. Meanwhile, the majority of the decrease in overall originations can be attributed to F rated loans out of Finland, which fell almost 40% to €3,257,445.

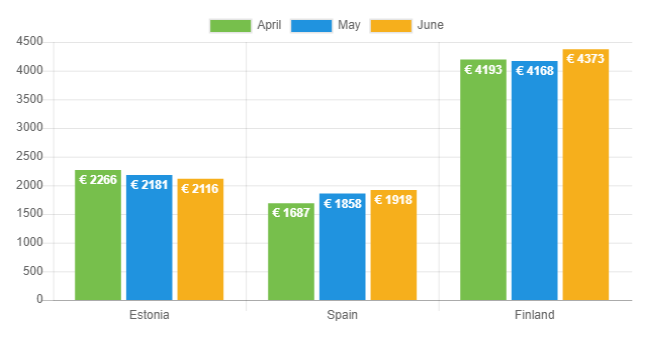

Mixed Trends in Loan Amounts

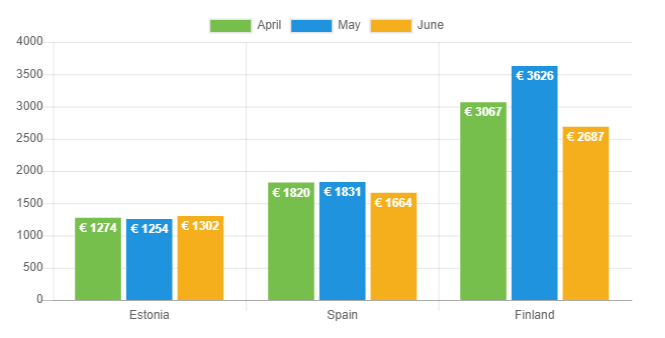

For the third straight month, the average loan amount increased in Spain. This month, the average loan amount totaled €1,918, a 3.2% increase from May. The opposite trend is being seen in Estonia, where the average loan amount decreased by about 3% to €2,116.*

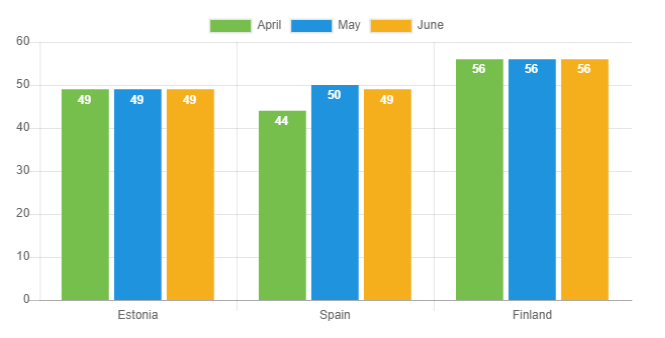

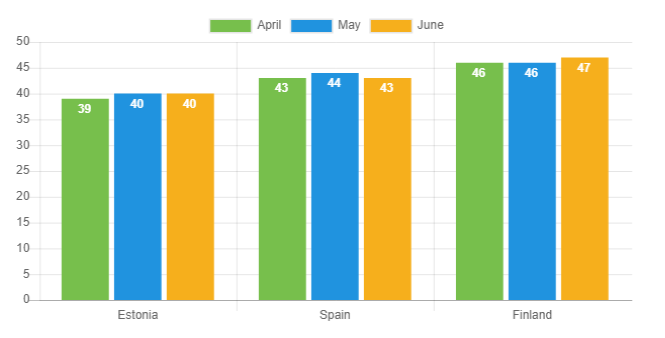

Loan durations remained constant in Estonia (49 months) and Finland (56 months). After jumping higher in May, Spanish loan durations fell slightly to 49 months in June. At the same time, the average age of borrowers showed no significant change compared to May.

Income Stats

The average income of a Finnish borrower fell in June. Borrowers from Finland made, on average, €2,687 this month compared to €3,626 last month. These lower income numbers did not play out in Estonia or Spain, where borrowers made just about the same, on average, as in May.

Education Levels Mixed, While Borrowers Employed Longer

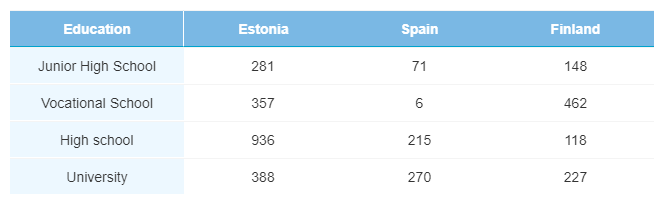

The trend in the education level of Estonian borrowers skewed lower, as more borrowers had a high school education. While there were less Finnish borrowers on the month, the overall education trend remained constant, with more borrowers attending vocational school than any other educational category.

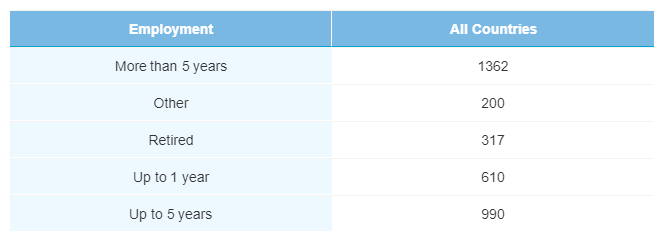

Meanwhile, a higher rate of borrowers in June have been employed for an extended period of time. 39.1% of borrowers in June have been employed for more than 5 years, an increase of 2% from the previous month.

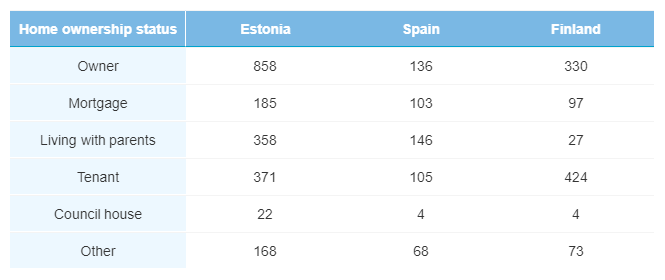

Home Ownership Status

Finnish borrowers skewed more toward home ownership in June, with 44.4% of borrowers being tenants, compared to a rate of 48.2% in May. Although there was an increase in the amount of Spanish borrowers, the overall trend in home ownership status in the country remained consistent with last month.

Verification Status

Verification status figures for June were mixed across the board. The rate of Spanish borrowers who have been verified by Bondora, 95.6%, was an increase from last month. Yet, fewer borrowers in Estonia (43.5%) and Finland (60.4%) were verified in June.

Mixed Trends Across the Board

There were a mix of changes in origination trends for the month of June. While less loans were originated in Finland, loans out of Spain saw an increase (which bodes well for those looking to invest in a mix of origination countries). Additionally, more borrowers had extended periods of employment.

Learn more about Bondora investment products here.