Return rates for Bondora originations were strong in October. Returns for 2021 were higher than in September. Although previous months’ return rates were slightly lower, they still held strong above their target rates.

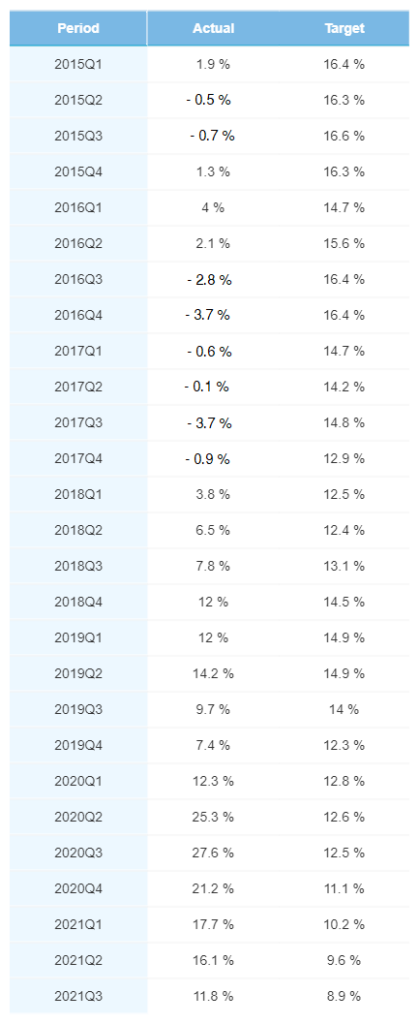

Yearly performance

The return for 2021 originations came in at 15.8% this month, up 0.4% from September. It’s also a solid 6.3% above target. Returns for Spanish originations (0% last month) jumped above their target rate to 6.3%. This is likely due to the relaunching of the Spanish market.

Returns for Estonian and Finnish originations were also higher by 0.4% and 0.7%, respectively. Meanwhile, 2020 originations returned slightly lower at 16.5% compared to 16.7% in September.

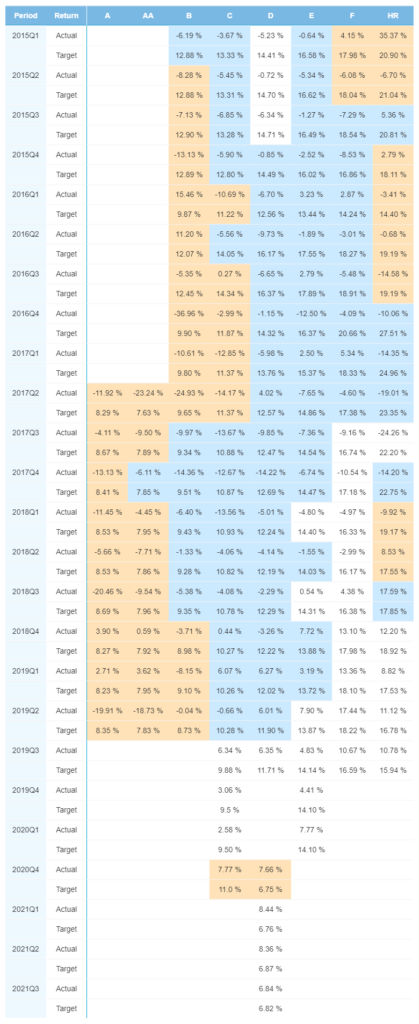

Quarterly performance

Returns for all three quarters of 2021 were higher in October:

- 2021 Q1: +0.2%

- 2021 Q2: +0.7%

- 2021 Q3: +2.3%

2020 quarterly returns remained very strong compared to their target rates. Originations in 2020 Q3 still retain the highest return rate over the past several years at 27.6%.

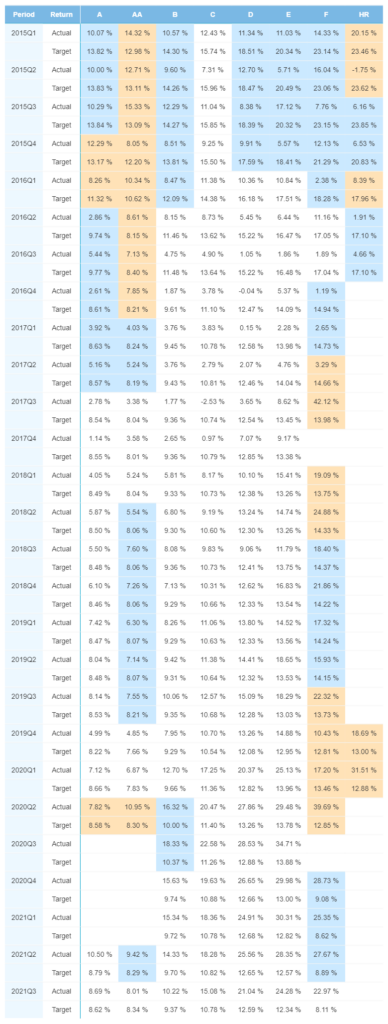

Finland

After coming in below its target rate for 2021 Q3, Finnish returns for the most recent quarter jumped up to 6.8%. Returns for the previous two quarters also rose: 2021 Q2 up by 0.6% and 2021 Q1 up by 0.2%. 2020 Q4 D-rated originations had the most significant jump, increasing by 5.46% to 7.7%.

Estonia

All seven originating categories saw their return rates rise for 2021 Q3 originations:

- A: +1.7%

- AA: +0.9%

- B: +1.6%

- C: +2.3%

- D: +3.0%

- E: +3.7%

- F: +2.9%

2021 Q2 originations also performed exceptionally well, with six out of the seven originating categories rising in return rates and all seven categories higher than their target rates.

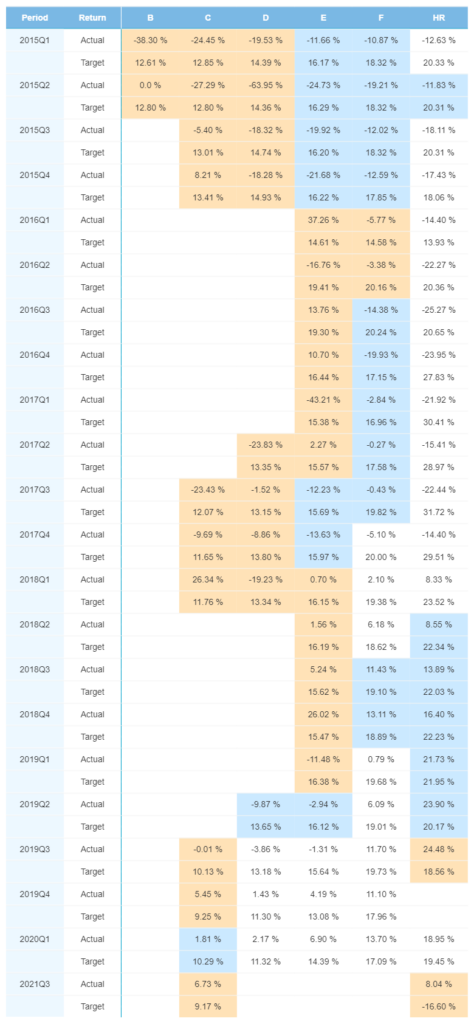

Spain

After 0% returns last month, 2021 Q3 Spanish originations were positive. C-rated originations returned 6.7% and HR-rated originations returned 8.0%. However, 2020 Q1 originations, the previous quarter for Spanish originations, were lower across all five originating categories.

Conclusion

Overall, Bondora originations had solid returns in October. Returns for 2021 originations were up 0.4%. The most recent quarter, 2021 Q3, led the charge, with returns growing by 2.3%. Estonian returns were higher across the board for all origination rating categories. Additionally, Spanish originations jumped into positive return rates for the most recent quarter as well.