Unless you are super lucky, you probably won’t build wealth overnight. Chances are you will have to work hard to create the financial future of your dreams. And this will likely take some time. But just because it will happen slowly, doesn’t mean you should become discouraged.

The truth is, long-term investments have many benefits compared to short-term options. But first…

What is a long-term investment anyway?

Long-term investments are the ones you expect to hold for a long period of time—typically multiple years—to cash out later in the future.

While short-term profits may lure investment beginners, investing for the long-term is vital for greater, sustained success. Furthermore, short-term trading and active investing may make you money, but tends to be more risky than buying and holding strategies.

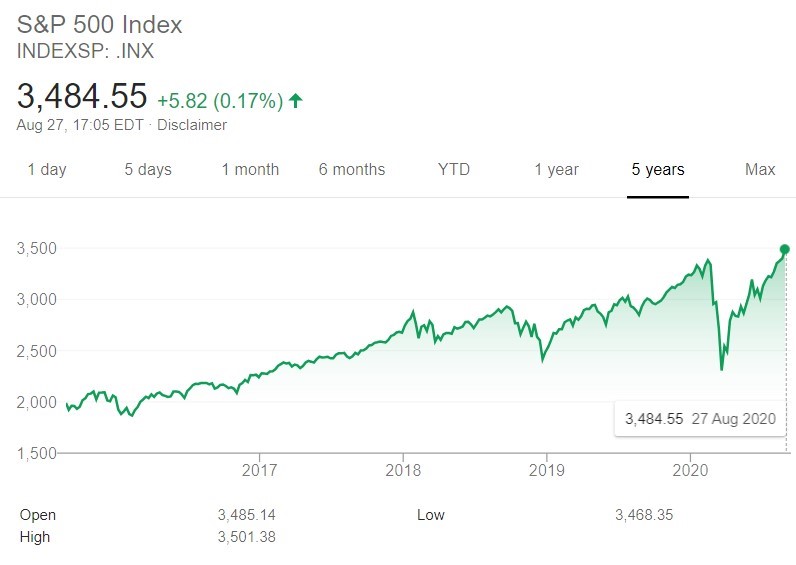

Volatility is flattened out by time

Once on the road, you wouldn’t change your tires each time you pass a bump, right? Instead, you would look at the long road ahead and keep driving even when going through some rough patches.

With investing, short-term volatility becomes irrelevant in the long-term. If you are holding an asset that falls down 5% today, you might be willing to act on it if looking for short-term profits. But when executing a long-term strategy, this 5% daily variance will be close to irrelevant as you have your sights on the next 10 years, for example.

So volatility is flattened out by time and it’s easier (or should we say less difficult) to predict the future behavior of the asset through overall trend analysis.

It’s so easy these days

Nowadays we have a multitude of online investment platforms that let you choose from several different asset classes, investment periods, risk ratings, etc. You can choose the asset mix that works best for you according to your plan and there will probably be a few online platforms to help you with that, accessible in just a few clicks.

A few years ago you had to physically buy a house to invest in real estate, for example. Now, you can simply invest in small shares of multiple buildings and see returns added to your account once they are done and sold. The same goes for investing in startups, using robo-advisers to buy stocks, harnessing the power of pre-set strategies with P2P-lending and even automatically copying other investor moves. And they’re all easily available to support your long-term investment journey.

Peace of mind

Watching fluctuations on your investments can make you anxious and stressed. And if you’re investing for the short-term, you may be obliged to make several regular micro decisions on buying, selling, holding and diversifying. This could quickly become a burden.

On the flip side, when you have a plan and invest for a long time, decisions were already made and you don’t have to constantly open your portfolio to see how things are going. That doesn’t mean you will forget about your investments for years, but it can definitely give you some peace of mind. It’s simply less stressing if you don’t have to deal with your money every day.

Less commissions and fees

Buying and selling assets comes at a cost. Most transactions will cost you money, either a percentage of the selling amount, a rate per transaction or some sort of fee per withdrawal. So, if your short-term investments require you to constantly rebalance the portfolio and operate on the assets all the time, these small fees and commissions when put together might total a big cost.

With long-term investing, you are typically buying one asset, be it real estate, stocks, bonds or something else, and holding it for a long time—betting on the rise of the asset price. So, if you are holding and waiting, there are no micro transactions nor the fees associated with it. You pay less to have your money somewhere and thus your final return rate could well be superior as your investment costs are lower.

Hasty decisions and emotions aren’t an option

While not having to make investment decisions all the time, and thus not rushing into choices you shouldn’t make, you also take emotion out of the equation.

What happens when a stock you believed would go up suddenly takes a nosedive? You are prompted to make a quick decision at a time when you may feel anxious, stressed or simply caught off guard not expecting that to happen.

When you have a long-term investment plan and goal, things are already laid out and unless something really bad happens, you don’t need to tap into your decision-making skills all the time.

If decisions need to be made, they likely won’t be as urgent and you will potentially have time to think on it before making a move.

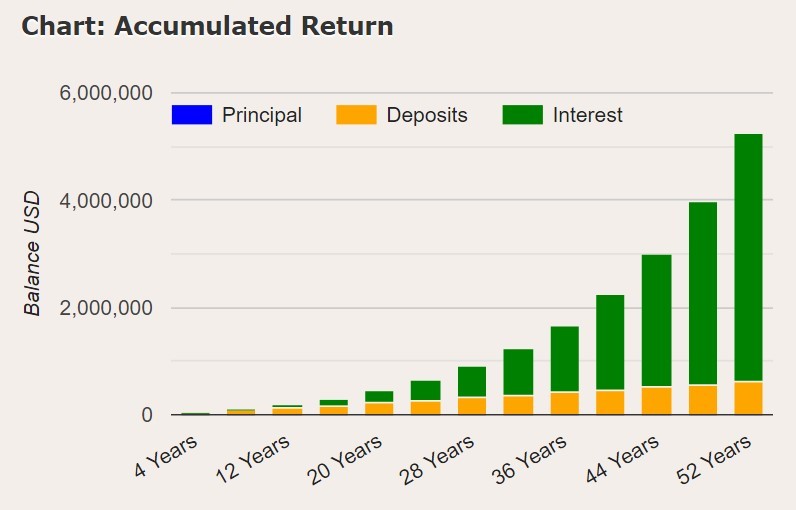

Compound interest loves time

Compound interest—who doesn’t love it? It’s so powerful and can only benefit your investment. But compound interest only really comes into effect with one special ingredient: time.

That’s because compounding is nothing more than applying the same return rates from period 1 on period 2, but now not only over your initial invested amount on period 1, but on period 1’s gains too.

It’s the famous snowball effect. Think about it, the snowball will never be big enough if the initial ball has only a few centimeters to roll. But if it has a whole mountain to slide down, it can become gigantic. That’s the thinking behind money and compound interest. It loves time and time loves it.

So when investing for the long-term, you can work with predictions that will be really impressive, and even small investing amounts can become huge sums over time.

To wrap it up

There’s no investment that fits all investor profiles. Short-term investing might be your thing, and it’s perfectly fine if you enjoy the adrenaline rush and feeling of control that comes when you day trade. There are investment options for everyone and you may opt to choose a mix of them all.

But long-term investment has some clear benefits that cannot be overlooked. Are you looking for more peace of mind, less decision-making and potentially a huge (positive) snowball effect with compound interest? Then this might be for you.

Just remember to prepare, plan and adapt your strategies when needed so your investments stay healthy while you do too!