Do you stress about money? Well, you’re not alone. Financial anxiety is a common issue many people face, especially in today’s uncertain economic climate.

The constant worry about bills, debt, and the future can significantly affect your mental and emotional well-being.

However, it’s essential to recognize that you are not alone in experiencing financial anxiety, and there are steps you can take to overcome it. Here are seven easy steps you can take to regain control.

How to Overcome Financial Anxiety

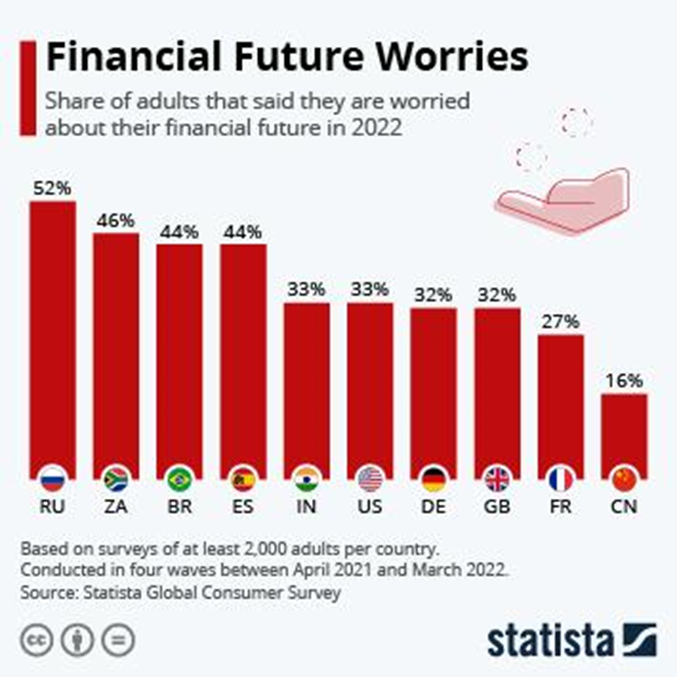

You’ll be surprised how widespread the issue of financial anxiety is. According to Statista, in some countries, almost half of the population worries about their financial well-being. High-income countries aren’t an exception to the rule — they are also on the list.

While anyone can feel financially insecure, you can still change your attitude and worry less or not at all. Follow these simple tips to stop worrying about your financial situation and remove the problem itself (not just symptoms).

1. Acknowledge your financial anxiety

The first step to overcoming financial anxiety is acknowledging that you have it. Given the various economic pressures, feeling anxious about money is perfectly normal. Admitting your concern is the first step towards finding a solution and regaining control.

2. Challenge your negative thoughts about money

Negative thinking is a significant contributor to financial anxiety. When you find yourself trapped in a cycle of negative thoughts about money, you must challenge them. Ask yourself whether these thoughts are based on reality or merely irrational fears. Often, we tend to catastrophize financial situations, making them seem worse than they are.

3. Set realistic financial goals

Setting unrealistic financial goals can exacerbate anxiety, especially when experiencing lifestyle creep. Instead, focus on developing small, achievable goals you can gradually build upon. Breaking down your financial objectives into manageable steps will give you a sense of accomplishment and reduce anxiety.

4. Take control of your finances

Taking control of your finances is a powerful way to reduce financial anxiety. Start by creating a budget that outlines your income, expenses, and savings goals. Stick to this budget diligently and make adjustments as needed. Paying off debt and saving for the future could provide financial security.

5. Build a strong financial support system

Don’t be afraid to lean on your friends and family for support. Discussing your money fears with loved ones can help you feel less alone. They may offer valuable advice or lend a sympathetic ear. Additionally, consider joining a financial support group or seeking guidance from a financial coach who can provide expertise and guidance.

6. Take care of your mental health

Financial anxiety can take a toll on your mental health. To combat this, prioritize self-care. Ensure you get enough sleep, exercise regularly, and maintain a balanced diet. When applied consistently, these measures can significantly affect your well-being and add power to deal with intricate issues.

7. Practice Mindfulness

Mindfulness is a valuable tool for managing financial anxiety. When anxiety creeps in, take a moment to focus on your breath and be present in the moment. Avoid judgment and observe your thoughts and feelings. This practice can help you gain perspective and reduce the intensity of your financial worries.

You can overcome financial anxiety

In conclusion, financial anxiety is a common challenge, but it doesn’t have to control your life. By acknowledging your anxiety, challenging negative thoughts, setting realistic goals, and taking control of your finances, you can overcome financial anxiety and regain a sense of peace and stability in your financial life. Remember, you are not alone; resources are available to help you navigate this journey toward financial well-being.

Want more money-savvy tips? Check out this article.