As has been typical in Bondora’s history, summertime tends to bring about loan originations and investment declines. June 2023 continues this trend from the past, with originations and investments each dipping to the €13M margin. One stat that picked up was the number of new investors joining Bondora, which we’re thrilled about. Here are more statistics from June:

1,338 new investors joined Bondora in June. In the same month, investors earned over €6M in returns, and the total investment amount increased by €15M!

Loan Originations

In June, loan originations totaled €13,404,803. This is a 30.8% decrease from May’s €19,376,714. When looking at past data for summer months, loan originations tend to decrease during this time. So 2023 remains in step with past trends.

All the markets originated less than the previous month, except for the Netherlands, which continues to thrive. It increased by 56.4% to €2,865,976 in loans. This is now the highest monthly loan origination total in our Dutch market history.

Despite declining by 48.4%, Finland had the largest share of all originations, totaling €6,987,695. Estonian originations declined 9.9% to €3,456,420, equalling a 30,3% share. The Dutch market continues to rise exponentially, growing by 56.4%. Spain decreased by 38.6% to €94,712. This is expected, as we’ve temporarily closed the market to new customer originations as we monitor data to change our internal risk-scoring models. We do this to ensure the best possible quality for our loan portfolio, which, in turn, means a better investment experience for you.

Finnish loans, once again, have the majority, with a 52.1% share. Estonia follows with 30.3%, the Dutch market with 21.4%, and Spain with 0.7%.

The average loan interest rate declined slightly to 19.2%.

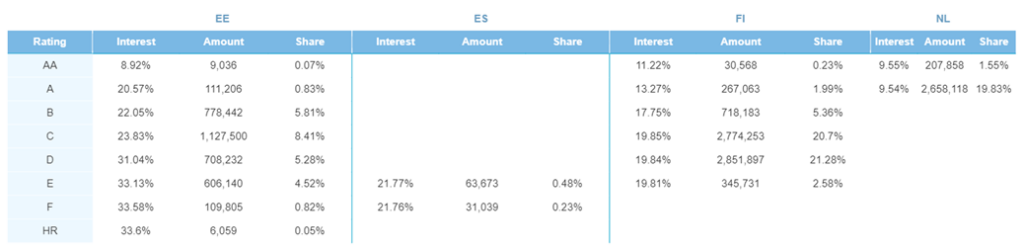

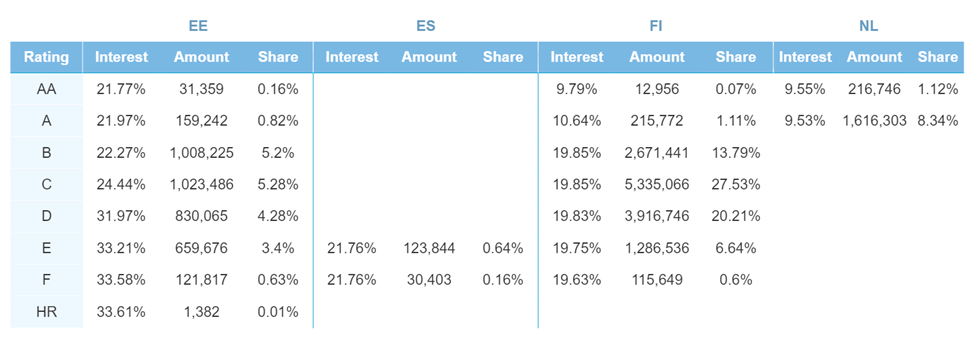

Loan risk ratings and split per country

Below you can view the different loan risk ratings and their percentage split across countries of the general loan portfolio. You can easily compare the changes between May and June:

For more in-depth statistics, you’re welcome to view them on our general statistics page for daily updated figures.

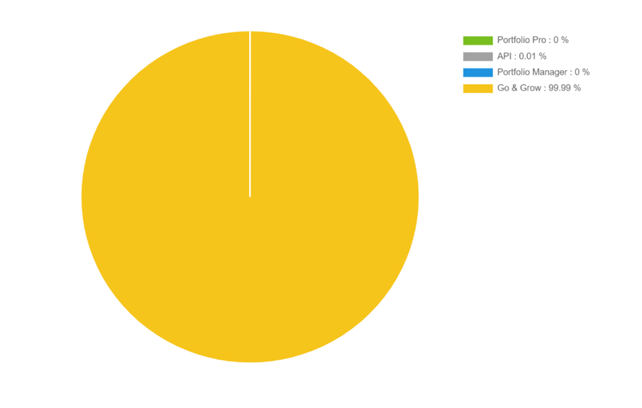

Investment product funding

In June, investments continued to decline, this month by 30.9% to a total investment of €13,339,612. Although this is quite a drop from the previous month, summer months are historically when investment activity declines.

Below you can see the investment funding split for June. But one of the reasons why investments were predominantly funded to Go & Grow was due to a technical error with our API. At the time of writing, this glitch has almost been fixed and is being tested to ensure it will run smoothly. Our team is also implementing new safeguards for the future.

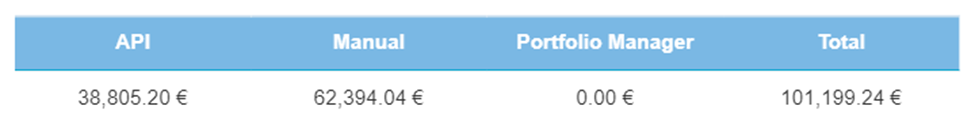

Secondary Market

Secondary Market transactions increased in June. This growth mainly came from manual transactions. Overall activity increased by 31.8%, equaling €86,916 worth of transactions.

The API decreased by 9.9%, and Manual transactions increased by 42.3%. At a 61.7% share, manual transactions still have the largest share, and the API has a 38.3% share.

Collection and Recovery

In June, we saw increases and declines in our collection and recovery efforts. 92,528 loan payments were recovered, which is a slight increase of 0.2% from May. On the other hand, cash recovery declined by 47.6%, totaling €931,585 being recovered. Despite the decline, this is still a substantial amount.

Remaining consistent with previous statistics, most cash and loan payments were recovered from Estonia, with €532,835 cash and 40,620 payments being recovered. In Finland, cash recoveries decreased by 22.2% to €346,610. Spain’s cash recovery figures climbed by 8.8%, totaling €52,130. There have been no recovery efforts in the Netherlands thus far.

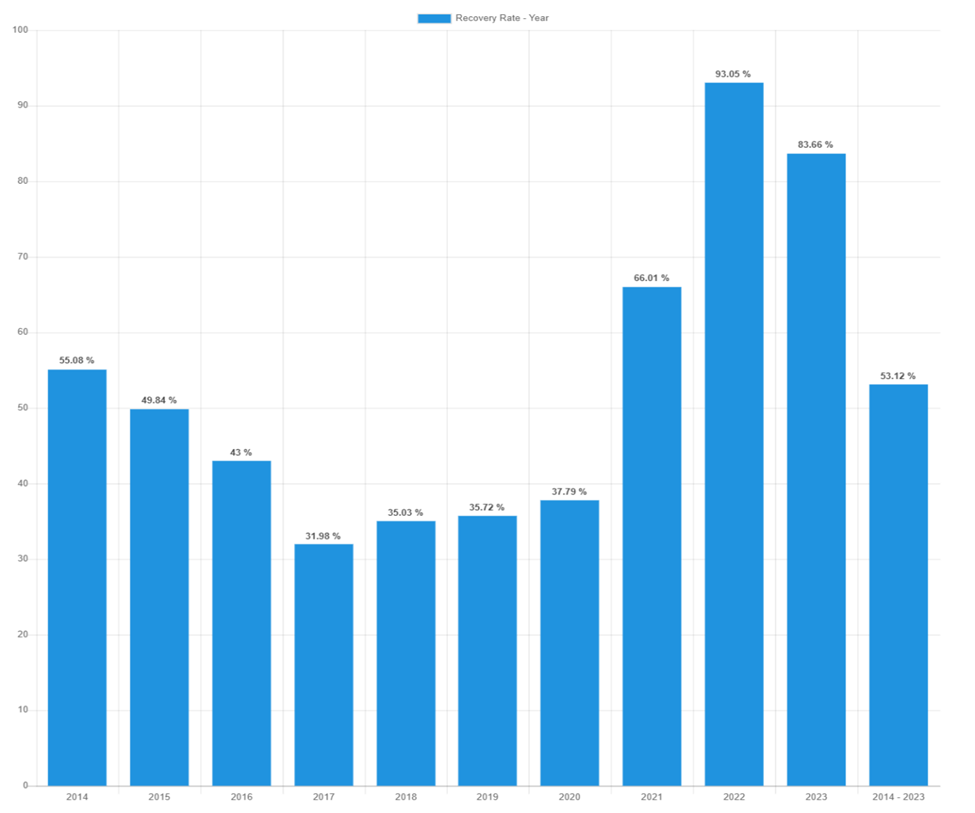

Once again, the 2014-2023 recovery rate remained stable with a slight increase, growing from 52.9% in May to 53.1% in June. Similarly, 2023’s recovery rate increased slightly in June to 83.7%, compared to 81.2% in May.

Visit our general statistics page for daily updates. Follow our blog to make sure you get all Bondora-related news first.