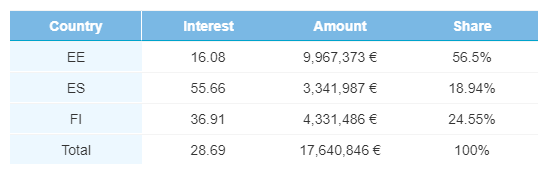

Bondora loan originations in November did not eclipse their record-breaking levels in October, but still came in at a solid €17,640,846. Over the month there were some changes in origination data, especially in Estonia and Finland.

Origination growth in Estonia, decline in Finland

While total originations declined, originations out of Estonia grew by 15.1% to €9,967,373. On the flipside, Finnish originations declined, down by 44.7% to €4,331,486. As a result, originations out of Finland only accounted for 24.6% of all Bondora originations, and Estonian originations accounted for 56.5%.

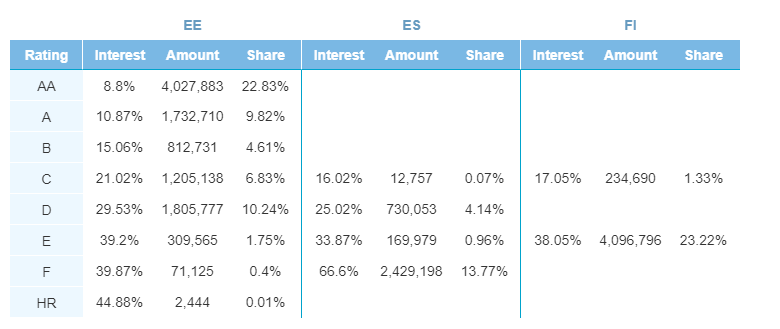

The increase in Estonian originations came mostly from AA rated loans, which accounted for 22.8% of all originations, totalling €4,027,883. The largest category of Spanish loans (F rated) declined to €2,429,198, lower by 26.0% from October. Loans in Finland once again came in from C and E rating categories, with E rated loans comprising 94.6% of all originations in the country.

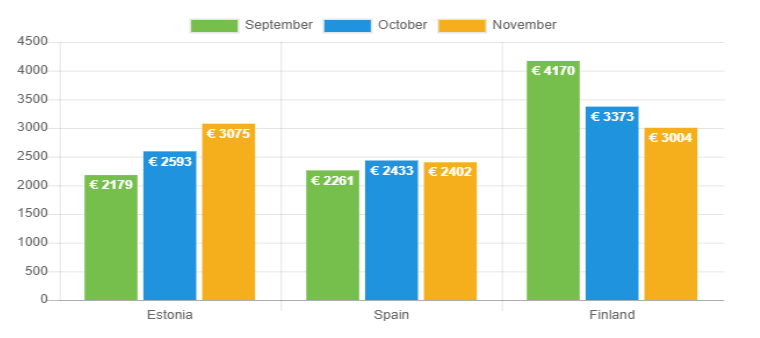

Loan amounts have a similar trend

Not only did total originations in Finland decline, the country’s average loan amount decreased too. The average Finnish origination totaled €3,004 in November, declining 10.9%. Estonian loans grew to an average of €3,075 on the month..

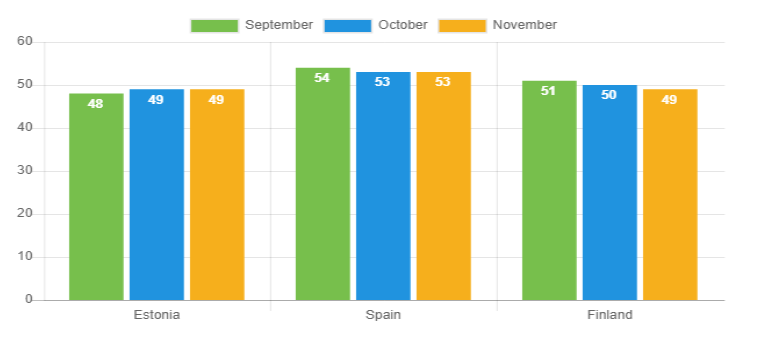

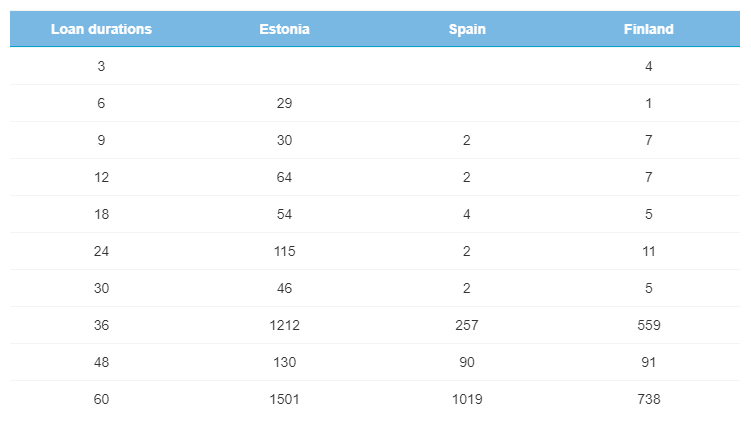

60-month loan durations see changes

Loan durations were consistent across Estonia and Spain, while Finnish loan durations fell for the third consecutive month, down to 49-months, putting them on par with Estonia.

Changes in durations were mostly seen in loans originated at 60-months. The average loan duration dropped in Finland because less loans (51.7%) came at a 60-month duration compared to October (53.0%). The same can be said of Spain, in which 73.9% of the country’s loans had a duration of 60-months. On the flipside, a higher ratio of Estonian loans (47.2%) were originated at a duration of 60-months in November.

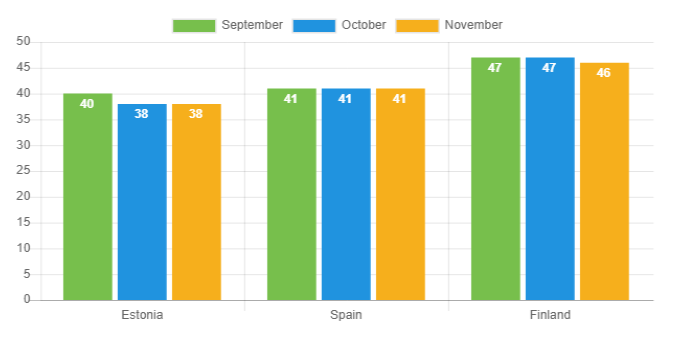

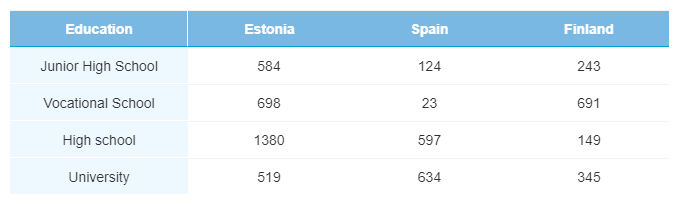

Average age and education remain consistent

There was no significant change in the average age of Bondora borrowers. Finnish borrowers came in slightly younger, at 46-years old, while the average age of borrowers in Spain and Estonia remained unchanged.

Similarly, the education levels of Bondora borrowers across Estonia, Spain, and Finland remained fairly constant over the month, and showed no statistically significant changes.

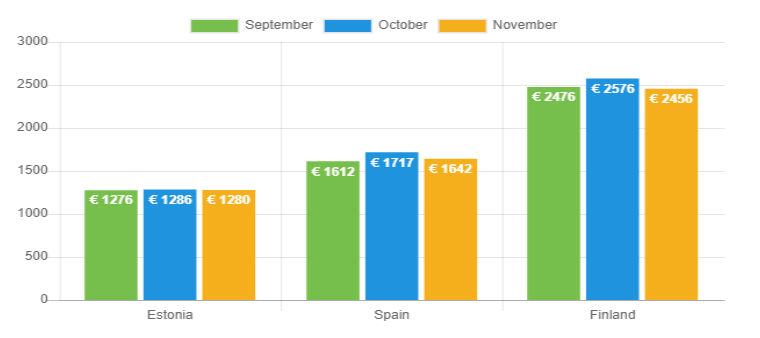

Income

Estonian borrowers did not report any real change in their average income on the month. However, Finnish borrowers averaged €2,456 p/m and Spanish borrowers averaged €1,642 p/m.

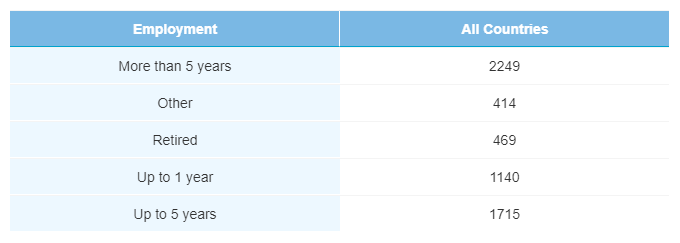

Employment

There was a slight decline in the number of Bondora borrowers employed more than 5-years (37.6%), but an increase of borrowers employed up to 5-years (28.7%). The amount of retirees (7.8%) also declined on the month.

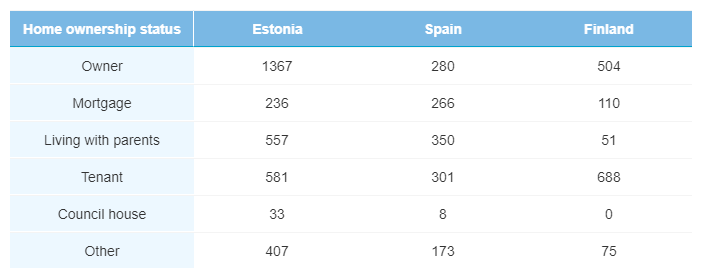

Home ownership status

Less Finnish borrowers (7.7%) and more Spanish borrowers (19.3%) had a mortgage in November. Meanwhile, homeownership in Finland rose to 35.3% of all borrowers in the country.

More verified Estonian borrowers

More than half (55.6%) of all Estonian borrowers were verified in November, a significant increase from previous months. There was also a solid increase of Finnish borrowers verified, with 72.9% of borrowers in the country verified compared to 69.1% last month.

Learn more about Bondora investment products here.

*As with any investment, your capital is at risk and the investments are not guaranteed. The yield is up to 6.75% p.a. Before deciding to invest, please review our risk statement or consult with a financial advisor if necessary.