Our cash recovered increased by 174.6% to €2,204,584. This is one of our highest figures in history and a new record for 2022! As in April, the majority was recovered from Estonia (€1,628,524). In contrast to April, when we set a new record for the number of missed payments recovered, this figure decreased in May by 3.7% to 76,359. Read more:

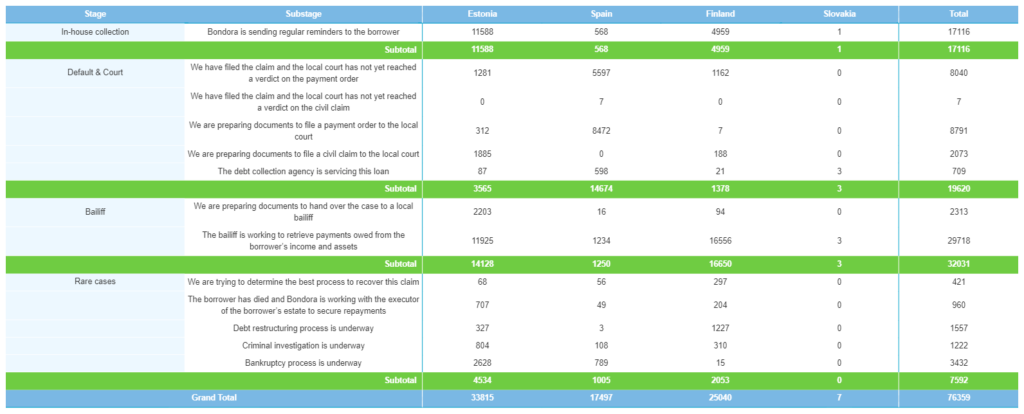

Regarding the country distribution for all 76,359 loans recovered, Estonia remains in the lead with a 44.3% share, despite a 10.0% decline. Finland follows in 2nd place with a 32.8% share, a 3% increase from the previous month. Spain’s share increased by 0.7% to 22.9%.

As has become the norm, most recoveries were made during the Bailiff phase, accounting for 32,031 loans—a majority 41.9% share. And again, the Default & Court phase had the second-most, with 19,620 recoveries—a 25.7% share. Both these categories declined, but In-house collections increased by 3.2% to 17,116 recoveries—a 22.4% share.

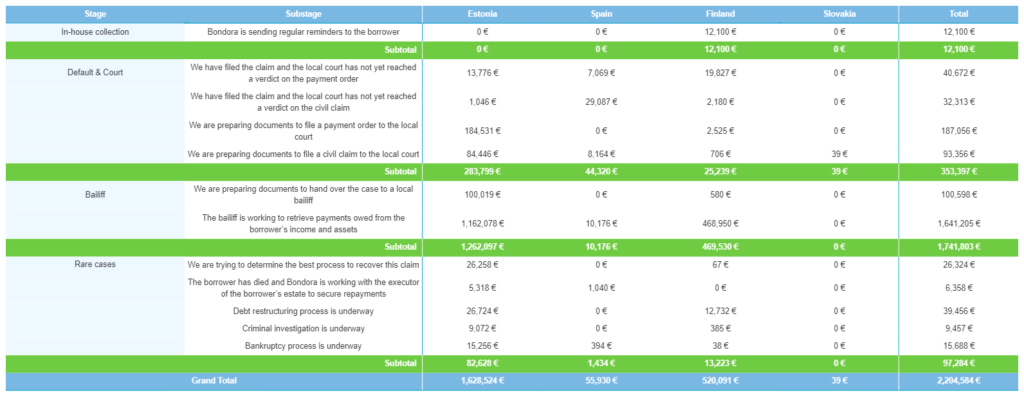

Cash recoveries

Due to the sale of old, defaulted loans from the Estonian market, we saw a phenomenal 174.6% increase, resulting in €2,204,584 being recovered in missed payments. When looking at country distribution, this leads to a 330.4% increase in Estonia, which equaled a 73.9% share. Finland followed in 2nd place with 23.6%, and Spain in 3rd with a 2.5% share. The latter declined by 16.0%, but Finland increased by 45.4%.

We saw increases across all recovery stage categories. Due to the sale, In-house collections saw some of their highest figures to date, with €12,100 recovered during this stage. This took up a 12.4% share. As expected, the Bailiff stage accounted for the most recovered cash, an 79.0% share. This was followed by the Default and Court stage with a 16.0% share. Lastly, we have Rare cases, with a 4.4% share.

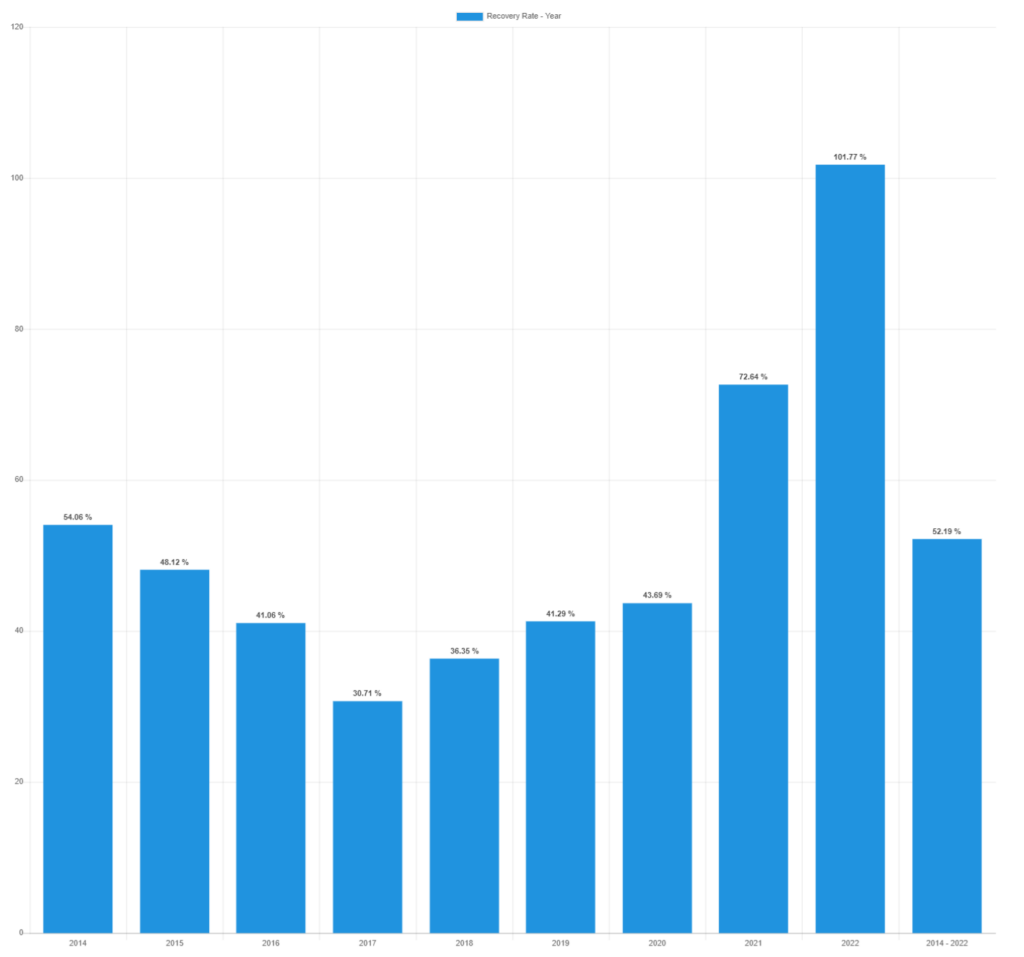

Yearly recovery rate

In May, the yearly recovery rate was 101.8%. This is some of the highest recovery rates we’ve seen halfway into a year. In April, 6 of the 9 years decreased, but this is completely reversed: 7 of the 9 years increased their yearly recovery rates in May. The lowest rate still comes from 2017, although it increased slightly to 30.7% from 29.4% in April. Unlike the unfinished 2022 year, 2021 still has the highest rate, 72.6%. The current 2014-2022 recovery rate is a striking 52.2%—a slight increase from last month’s 51.0%.

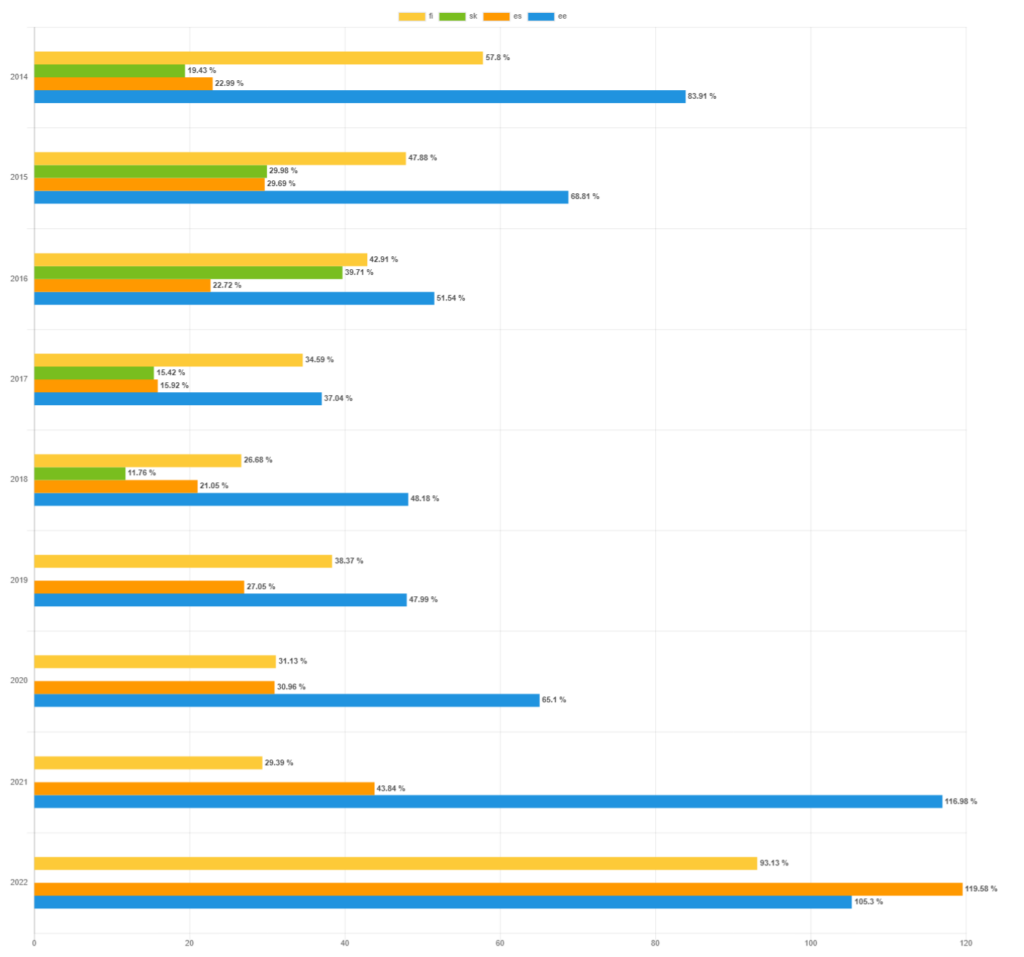

Recoveries by country

As we saw in April, Spain remains an outlier for 2022 recoveries, with a recovery rate of 119.6%. Estonia follows with 105.3%, and Finland has a 93.1% recovery rate for this year. As was the case in previous months, Estonia retains the lead for the other years before 2022. Its most significant lead is in 2021, with 117%, Spain takes 2nd with 43.8%, and Finland trails with 29.4%.

Summary

Our collection and recovery figures continue to shine in 2022. With a new record high for cash recovered in 2022 (€2,204,584), we’re happy with our collection efforts. Estonia holds the lead in recovery rates from 2014 to 2021, but when it comes to 2022, Spain continues to lead the charge. Although the number of missed payments collected is less than in April, 76,359 is very much in line with average recovery rates.

The phenomenal increase and off-the-charts figures of the cash recovered can be directly traced to the sale of old, defaulted loans from the Estonian market (you can read more about that sale in this blog post). We expect next month to revert to more familiar figures, as this sale of old loans was an outlier in statistics.

You can always view missed payment recoveries and all other Bondora data. Check out our real-time statistics to see recovery data on all Bondora missed payments and loan history, returns data, etc.