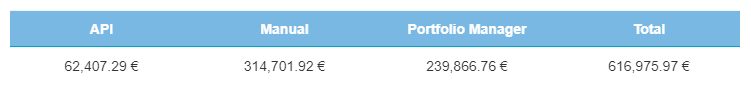

After the spike in secondary market transactions in March, May’s numbers continue the descending trend we started seeing in April. Secondary market transactions totaled €616,975 on the month, showing a more gradual decrease of 29.5% compared to last month’s 34.3%. Portfolio Manager transactions accounted for most of the decline, showing a 40.8% decline from €405,371 in April to €239,866 in May. Unlike in April, manual transactions followed suit with a gradual decrease of 13.9% over May.

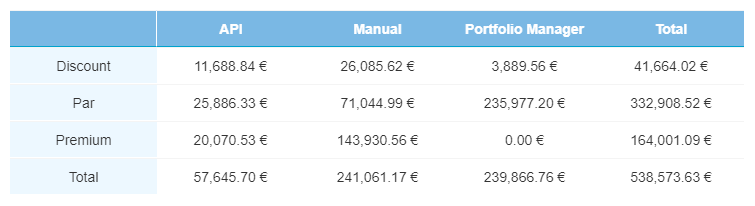

Current Loans

Current transactions at a premium saw a 16.8% jump from April, which lead to the subsequent increase of 7.9% in manual transactions on the month. Meanwhile, after continuing its recent growing trend, we saw discount transactions settling again at 7.7%—a decrease of 14.5%. Overall, transactions for current loans were down 32.5% in May, slightly less to last month’s 36.8% decrease.

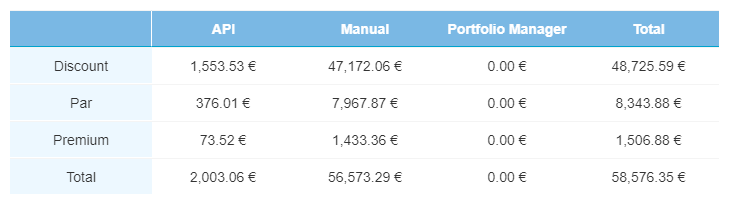

Overdue Loans

Transactions of overdue loans continue their rise from April with 30.5%, more than double last month’s increase. As in April, the majority of overdue loan transactions came from manual transactions at a discount, totaling 83.4%. API transactions continued to fall with 3%—a strong contrast to April’s 40.0%.

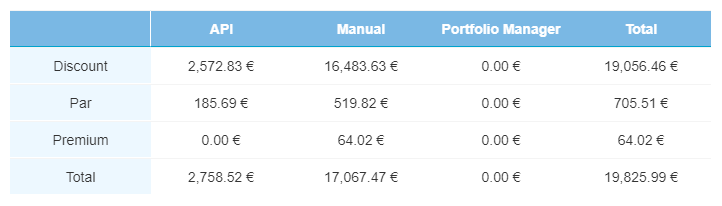

Defaulted Loans

After last month’s rise, defaulted loan transactions saw a 36.6% decline. API transactions bounced back from a total of €1,928 in April to €2,785—a growth of 7.7%. Manual transactions, on the other hand, fell by the exact same rate as API’s growth, declining by 7.7% to €17,067.

Secondary market transactions continue to slow down

The overview of May’s secondary market transactions reflect a similar downward movement as we’ve seen in April. This is a natural return to historical figures after the spike in March as investors looked for liquidity in their investments amid economic uncertainty.

Always remember, investors should not seek higher returns from buying and selling loans on the Bondora secondary market.

You can learn more about the Bondora secondary market here, or contact an experienced Investor Relations Associate at [email protected].