Both originations and investment funding declined slightly in May, but remained at sustainable growth levels. Investment funding totaled 15,458,394 and loan originations totaled €15,618,880. Read more:

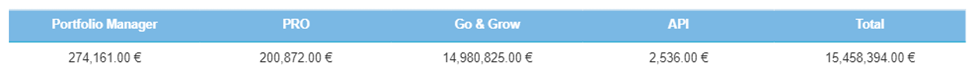

After setting new highs for investment funding in April, May’s figures declined by 0.6% to €15,458,394. Go & Grow remains the overwhelmingly significant product with €14,980,825, Portfolio Manager follows with €274,161, then Portfolio Pro with €200,872, and lastly, the API with €2,536. In April, all products showed increases; however, in May, only Go & Grow increased its funding:

Product funding figures:

- Go & Grow + 3.5%

- Portfolio Manager – 54.4%

- Portfolio Pro – 57.1%

- API – 70.7%

After having the most impressive growth rate in April, the API tumbled down to having the worst rate, declining from €8,669 to €2,536 invested. Portfolio Manager and Portfolio Pro decreased their investment funding by more than half. Go & Grow nearly managed to surpass the €15M mark, but we’ll see if that happens next month.

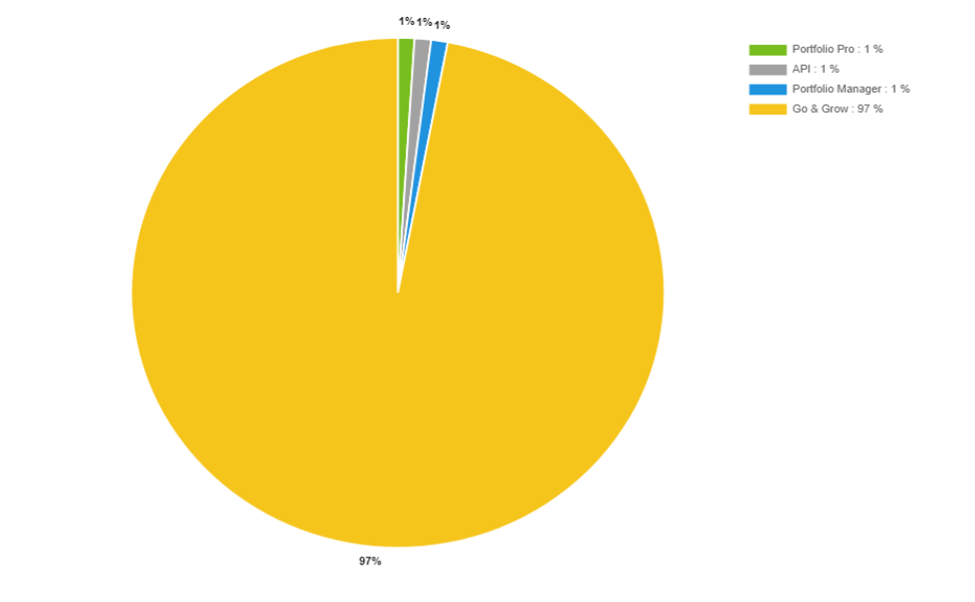

Investment by product

In contrast to previous months, we actually have visible changes in the shares of the different investment products. Portfolio Pro and Portfolio Manager both dropped down to 1% shares. Of course, this means Go & Grow increased from 93.1% to 97% in May. This comes down to a total of €14,980,825 invested.

Portfolio Manager has €274,161 invested—a 1.8% share (compared to 3.9% in April). Portfolio Pro has an investment total of €200,872—a 1.3% share (compared to 3.0% in April). And lastly, we have the API, which has a virtually 0% share—equal to €2,536 invested.

Loan originations

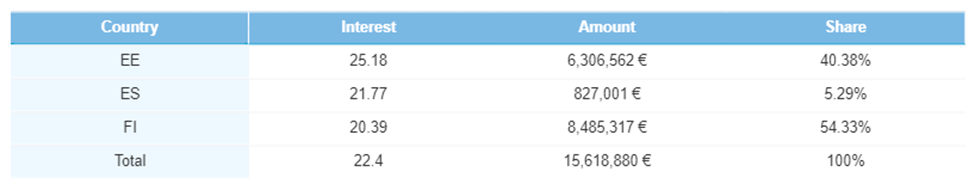

May showed a slight decline of 0.5% in loan originations, dropping from €15,697,955 to €15,618,880.

In contrast to the amount originated, the average interest rate increased from 22.1% to 22.4%. Here’s a breakdown of all the origination stats:

Country breakdown

Spain continues to be the poster child for origination growth, increasing by an impressive 31.7% to €827,001. At this rate, we should pass the €1,000,000 mark for Spain in June. But let’s not count our chickens before they’ve hatched.

Finnish loans still have the largest origination share (54.3%) despite declining by 9.7% to €8,485,317 being originated. Estonia increased its 2nd largest share from 36.1% in April to 40.4%, equaling €6,306,562 originated. Spain increased its 4.0% share to 5.3%.

The average interest rate increased slightly from 22.1% to 22.4%. For the first time in months, the average Estonian interest rate isn’t responsible for this increase, as it decreased by 0.3%. Instead, the Finnish interest rate’s increase of 0.3% titled the overall average. The average Spanish interest rate remains consistent at 21.8%

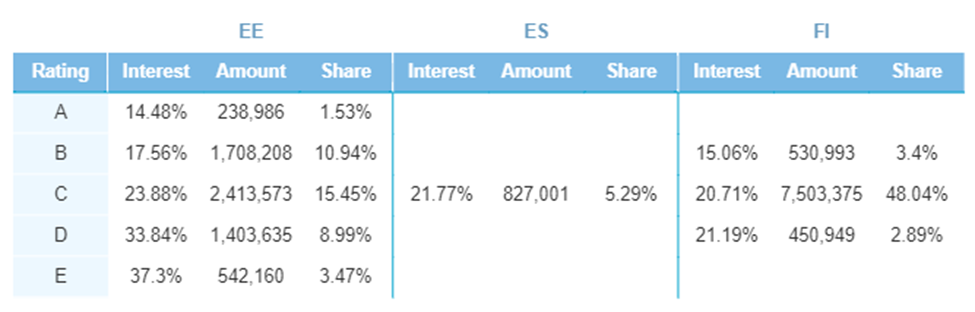

Continuing its slow, sustainable growth, Spain increased its share of loans from 4% to 5.3%. This still consists solely of C-rated loans. This risk-rating category is also the most popular in our other loan markets. In Estonia, its category’s share is 15.5%, and in Finland, C-rated loans make up 48.0% of all loans.

The other two categories in Finland, B- and D-rated loans, decreased by 0.4% and 0.1%, respectively. In Estonia, the same categories increased by 1.5% and 0.9%, respectively.

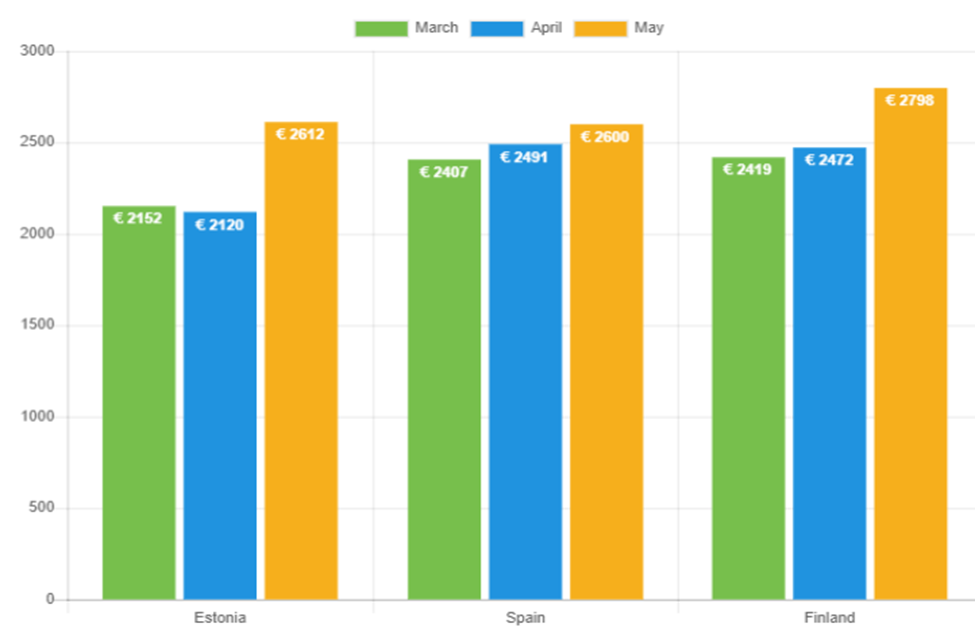

Loan amounts

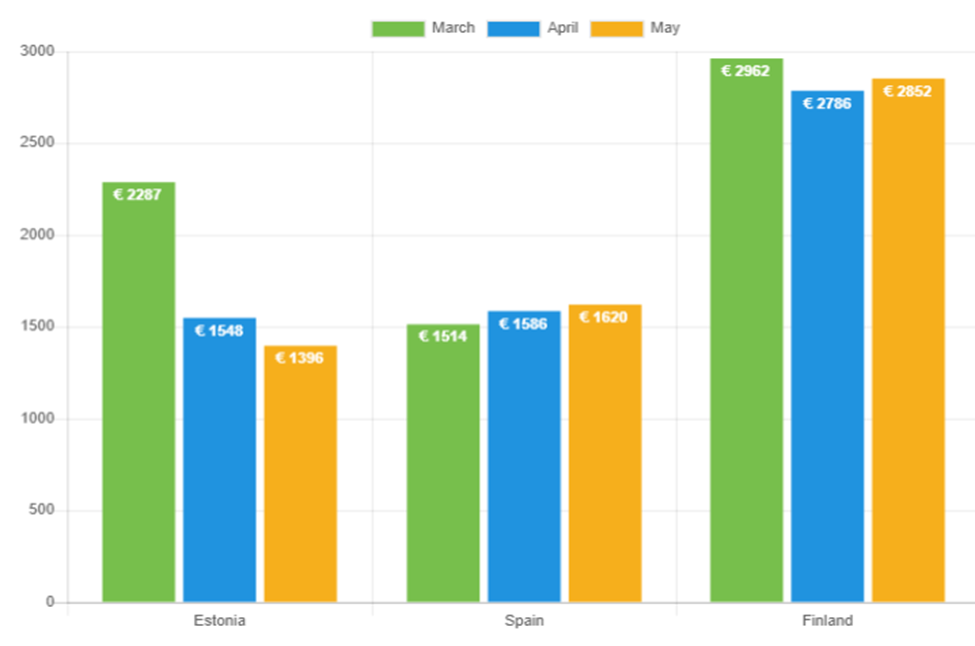

In May, the average loan amount for all three loan markets increased. This is the first time in 8 months that the average Estonian loan amount has increased, and it did so with an astounding 23.2%. In Finland, the average loan amount increased by 13.2%, and in Spain by 4.4%.

The see-saw trend from the last couple of months continues, as Finland regains the lead from Spain with the highest average loan amount (€2,798). Estonia has the 2nd largest amount (€2,612), but Spain is very close with €2,600.

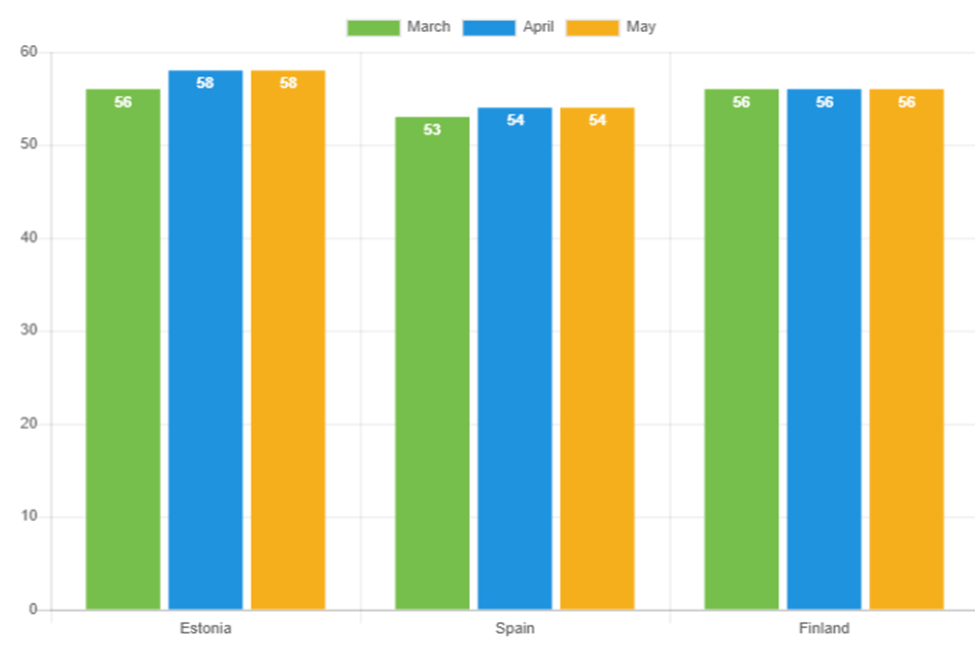

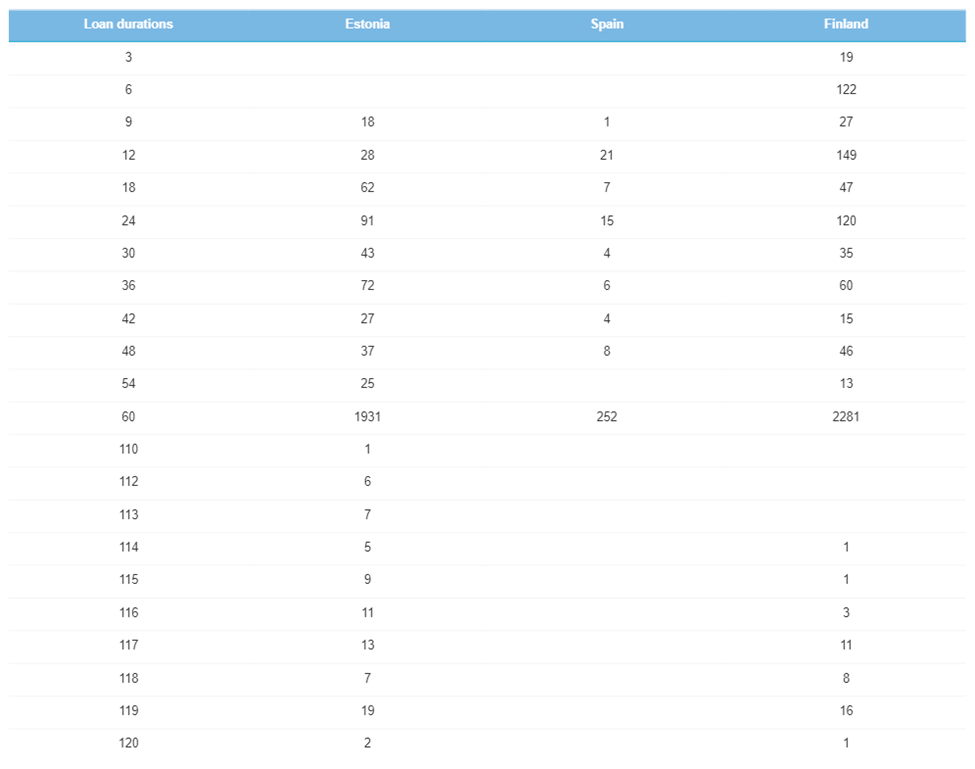

Loan duration

The average loan duration lengths across all three markets remain unchanged from April. Estonia has the longest loan duration (58 months), Finland the 2nd longest (56 months), and Spain the shortest (54 months).

Once again, 60-month loans prove to be the most popular across all our markets. This duration has a consistent majority in each country: in Estonia, 1,931; in Spain, 252; and in Finland, 2,281. In Spain and Finland, 12-month loans are the 2nd most popular, with 21 and 149 borrowers choosing this duration. And in Estonia, 91 borrowers chose the 24-month loan duration.

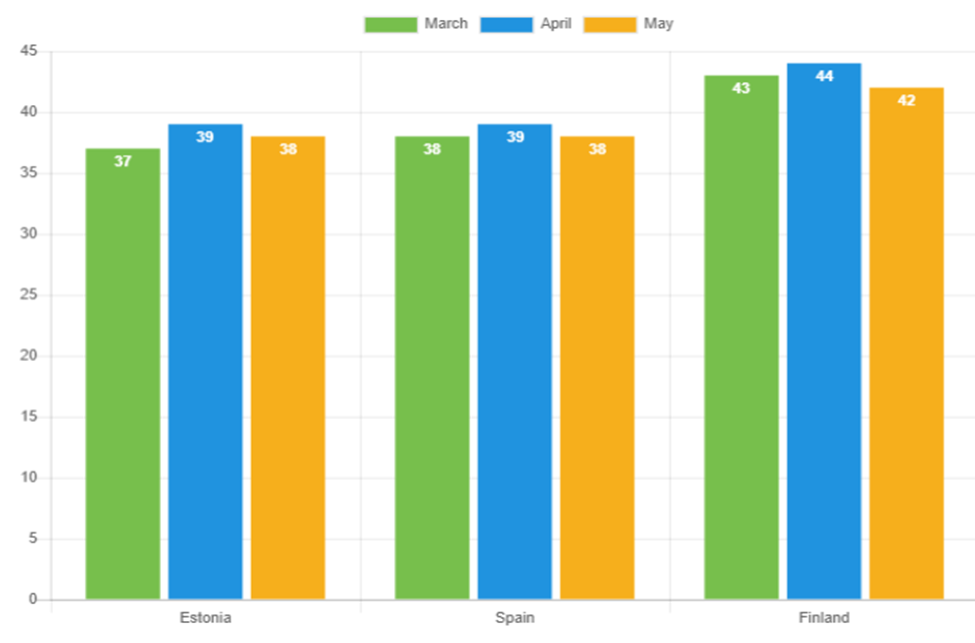

Average age

There was a drop in average across all three markets. But, some overall trends remain the same. Finnish borrowers remain the oldest by far, with 42 years. Estonian and Spanish borrowers’ average ages are the same, at 38 years.

Income

Spain was the only market to increase the average net income in April, but Finland joined them in May. The average net income per borrower in these countries is €1,620 and €2,852, respectively. In Estonia, the average net income dropped slightly (-9.8%). Estonian borrowers continue to have the lowest average monthly net income.

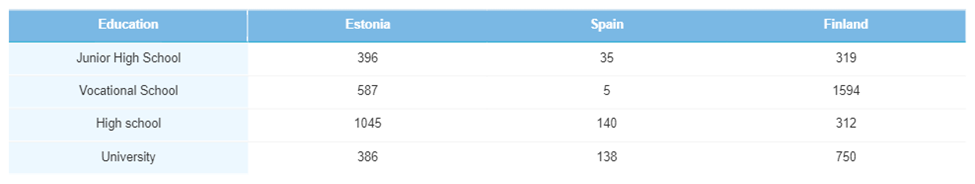

Education

In Finland, the majority of borrowers (53.6%) continue to have vocational school qualifications. In Spain and Estonia, this same category is much less populated, accounting for 1.6% and 24.3%, respectively. High school qualifications make up the majority, 44.0% and 43.3% in these two markets, respectively. Looking at the statistics, vocational schools make up the majority (38.3%), due to Finnish borrowers making up the largest percentage of borrowers overall.

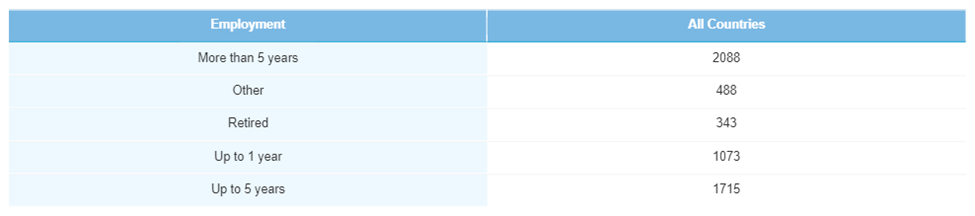

Employment

As has been the case for multiple months, the employment statistics remain stable. Most borrowers (36.6%) are employed for more than 5 years. Those employed for up to 5 years account for the 2nd largest share of all borrowers (30.1%). And retirees remain the least populated segment, accounting for just 6.0% of borrowers.

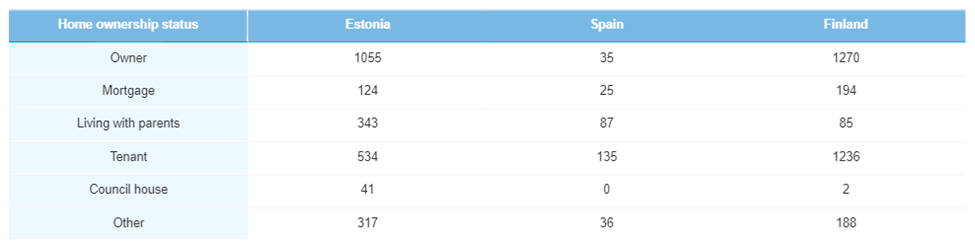

Homeownership status

Most Bondora borrowers continue to be homeowners (41.4%), predominantly because of the high percentage of Finnish homeowners (42.7%). In Estonia, this is also the most popular category, with 43.7% of borrowers owning property. In Spain, Homeowners make up only 11.0%, and the most popular category is tenants (42.5%).

Verification status

This month, we only have a few unverified borrowers in Estonia and Spain. Finland, once again, has a 100% verification rating. Estonia has a much improved 98.5% rating (91.4% in April), and Spain has a 99.1% rating. This brings the total verification rate to 99.3%.

Stable, sustainable growth

After setting new highs for investment funding in April, May’s figures stabilized at €15,458,394. Originations were also stable compared to previous months’ figures, totaling €15,618,880. Most of the statistics remained relatively consistent as well. This consistency and stabilized figures show our stability and sustainable growth.