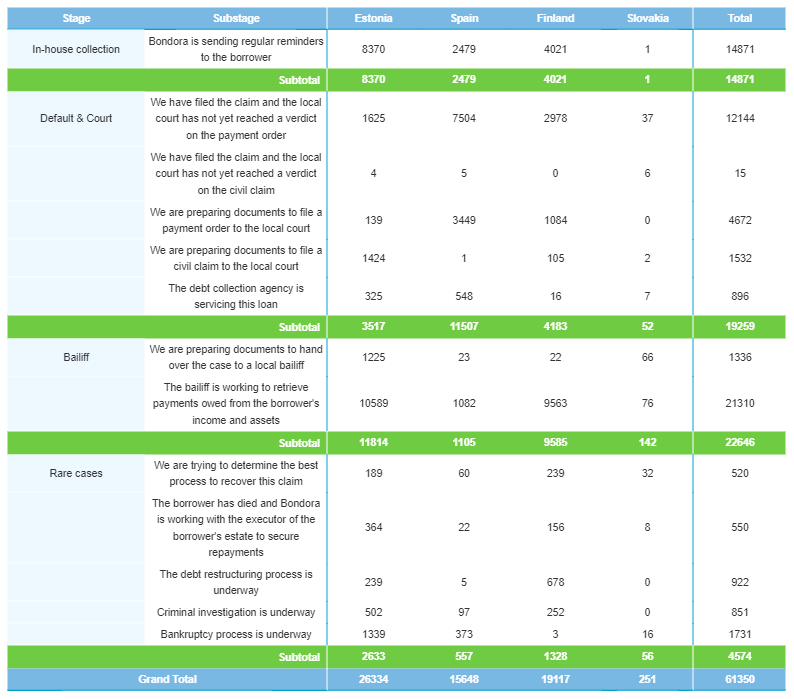

July marked the 6th consecutive month of increases in Bondora’s recovery and collection cases. The number of cases totaled 61,350. With an increase of 2.2% from last month, this encouraging growth shows that Bondora’s efforts to recover missed payments are effective.

We saw impressive growth in nearly all the categories, with the exception of in-house collections, which had a 4.5% decline. It is, however, quite normal for data to fluctuate from month to month. In June, the Default and Court stage of collections showed only 1.5% growth, whereas in July, it grew by 8.9%—the largest growth rate across all categories for the month.

Estonia and Spain continue taking turns for the biggest increase, with Spain growing by 2% and Estonia coming in close second with 1.8% growth from June’s numbers. Estonia, however, still holds 42.9% of the total—the biggest portion of recoveries.

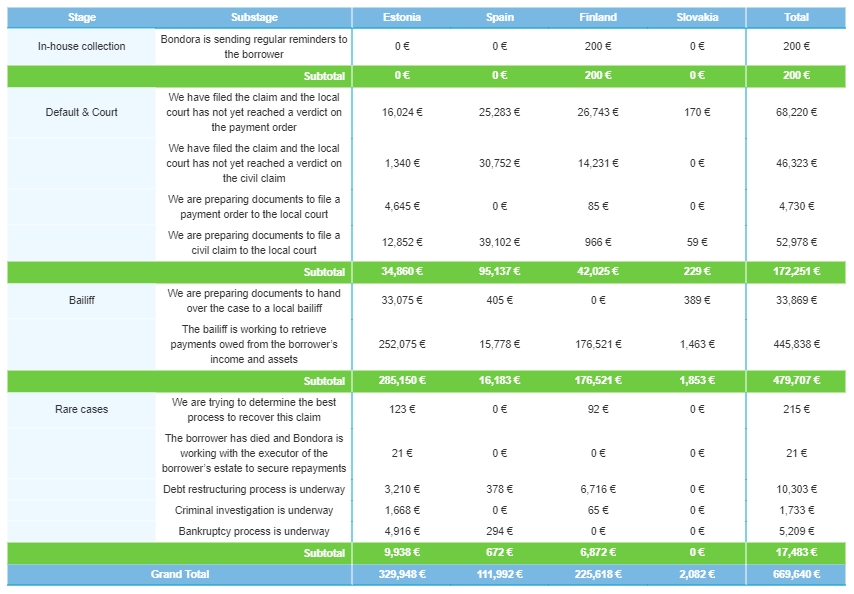

Make way for cash recoveries

July follows in June’s impressive footsteps. Last month, the cash recovery growth rate nearly tripled with an 8.6% increase from May’s 3.3%. This month, it nearly doubled, totaling 17.1% growth on the month. Slovakia continues its rollercoaster trend we’ve been seeing in recent months, escalating with 157.7% after plunging by 76.9% last month.

The Bailiff stage recovered €479,707—the largest amount in the collection and recovery process. It accounts for 71.6% of the cash flow for July.

€669,640 was recovered across all the countries, with Estonia (€329,948) and Finland (€225,618) having the largest recovered sums. €111,992 was recovered in Spain, a 6.3% growth from last month’s numbers.

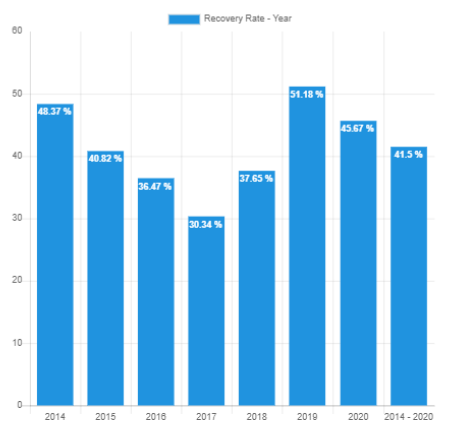

Yearly recovery rate

The seven-year cumulative recovery rate is currently 41.5%—just 0.6% lower than last month. 2020 is still showing the second highest recovery rate of the last 4 years (45.7%), and 2019 still holds the lead with 51.2%. Recoveries for 2017 and 2018 dropped slightly with 1.1% and 1.6%, respectively.

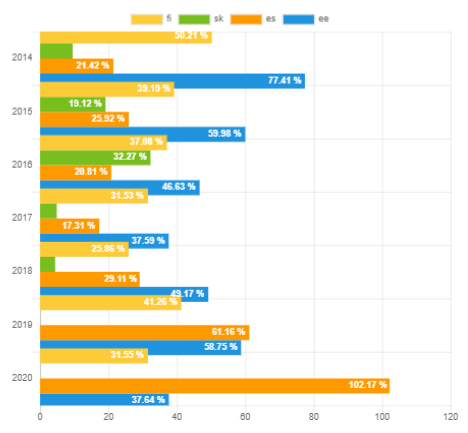

Estonian recoveries are holding up

During the last three months there has been an overall decrease in figures for the recoveries by country, with the exception of Estonia’s 2020 recoveries, surging from 25.2% in May, to 30.8% in June, to 37.6% in July. This strong increase in recoveries for Estonia is especially valuable, seeing as they make up the majority of loan originations as well.

2020 recoveries going strong

Having an increase in recoveries for the 6th month in a row is no easy feat. Bondora continues to prove to investors that it can recover missed payments from borrowers and maintain steady investor returns, despite the challenging times. With strong growth in certain categories and stability across others, we’re feeling confident that this quarter will continue the strong strides we’ve seen thus far.

You can always view missed payment recoveries and all other Bondora data at any time. Check out our real-time statistics to see not only recovery data on all Bondora missed payments, but loan history, returns data, and more.