What do you think it takes to become a millionaire? A huge inheritance? Maybe a thriving global business? It might seem like becoming a millionaire is very far away, but in fact, it really isn’t. With some careful planning and a solid investment strategy, you too could become a millionaire in your lifetime.

Growing your wealth into the millions takes patience and persistence. But don’t be fooled, it’s still something that anyone with a regular job and strong budget can accomplish. Let’s look at three different investment plans that are not only attainable, but realistic for most working people.

A saving state of mind

Before we get into savings plans themselves, we want to highlight that saving is not just something you need to do, it’s a state of mind. Becoming a saver might take a total change in the way you view money and your earnings.

Unless you are the CEO of a major company or have an extremely high-paying job, the path to becoming a millionaire will require financial discipline. Saving money should become a habit that you embody regularly; it should be second nature in your life. Getting a strong financial education is key to understanding why saving is so important.

But it’s not that you are just saving for its own sake, you are saving in order to invest. When you invest your savings over time, you can grow your wealth in ways that you may never before have imagined. The sooner you begin to save and invest that savings, the easier it will be to become a millionaire and lead a financially independent life.

Example plans

Don’t believe you could ever become a millionaire? Think again. People with regular jobs and incomes can’t imagine growing their wealth into the millions, but with proper savings and a strategic investment plan, even families who are not particularly wealthy can achieve this milestone. One of the biggest ways to accomplish this is to take advantage of compound interest, where financial gains are reinvested over time and generate what is known as the “snowball effect” on returns. You can check out more about compound interest here to learn about how this phenomenon can positively impact your finances.

In our examples, we will illustrate how compound interest and regular savings can lead to financial growth. To better understand these examples, let’s define the inputs to illustrate each investment strategy:

- Starting amount – The beginning amount you have to invest

- Investment per month – The amount you can afford to save and invest each month

- Returns – The rate of return you expect from your investment

- Returns compounded – How often the returns are calculated on your investment

- Investment increase – The amount you plan to increase your investment each year

- Years – The total number of years on your investment plan

These are the factors that help determine how much an investment will grow over time. Each of these inputs on their own is important, but together they paint a picture of how your savings and investments will play out in the coming years.

Now that we’ve defined our savings and investment factors, let’s see how you can get to become a millionaire with an investment plan of your own!

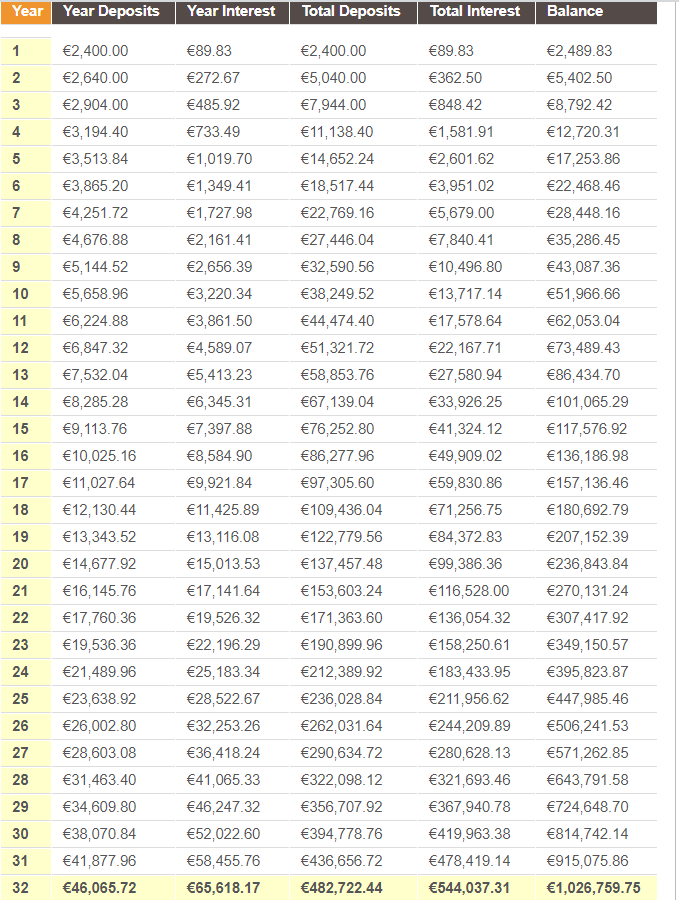

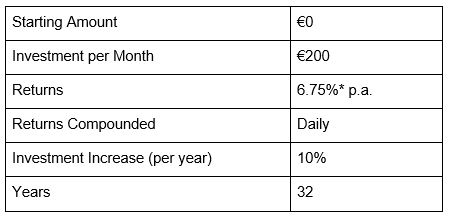

Just starting out

This plan is for those who are just starting out on their investment journey. In this plan, we assume that you are starting out with no money to invest, but with a plan to start saving €200 per month to allocate toward your savings, and growing this investment 10% per year. This scenario applies to anyone who is in the beginning stages of their career and can expect a natural progression in their careers, allowing them to invest more money over time.

In the following examples, we have used a rate of 6.75%* p.a. The returns are compounded daily.

Following this plan, you can calculate your current age and add 32 years to determine when you will become a millionaire. Sound crazy? It’s actually not. As you can see, this is a realistic plan for someone in their 20s or early 30s to accomplish before they reach the age of retirement. Think about it. If you are 25 years old today and stick to this investment plan, you will become a millionaire by the time you are 57 years old!

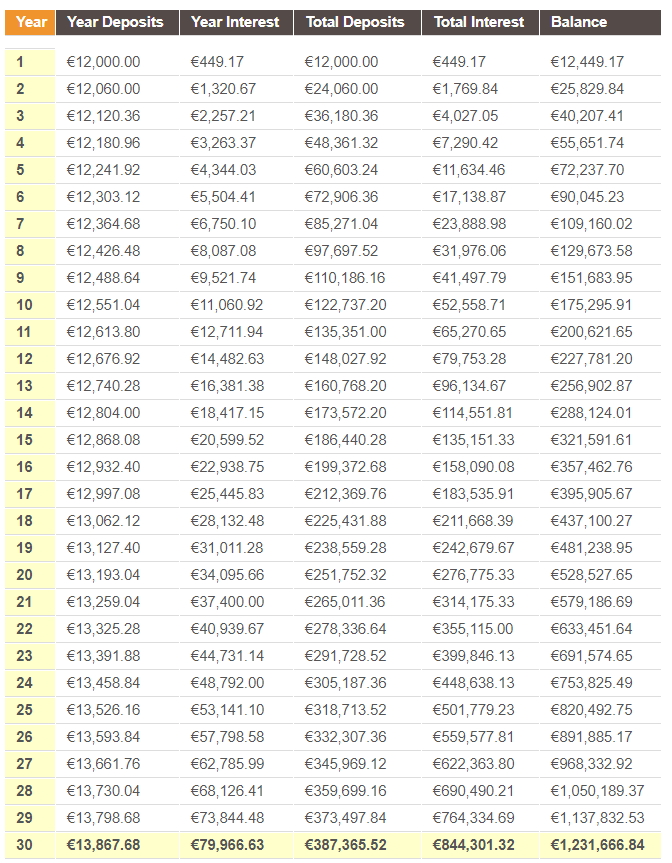

Higher salaries

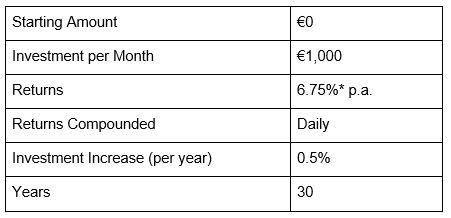

In this next example, we assume that you are someone who doesn’t have any money to invest today, but has established yourself in a well-paying job, and therefore can afford to save and invest more money each month. For our purposes, we assume that you can already afford to save €1,000 per month, and increase these savings by 0.5% per year.

In this scenario, it would only take 28 years of saving to get to €1 million. Because you can afford to save more money off the bat, you are able to reach the millionaire mark quicker than in the previous scenario. Even more, this is all done by starting out with no savings at all, meaning, you can start saving right away.

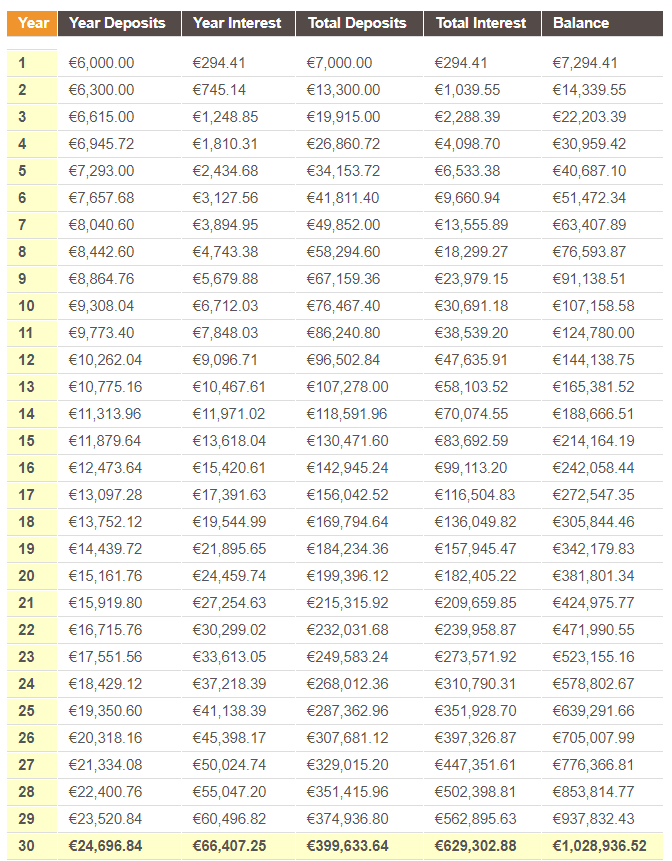

Already money to invest

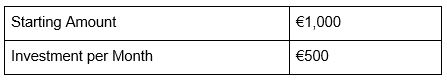

In our last example, we assume you are someone who already has some money to invest and is able to save money regularly to continue growing your investment. Let’s say you already have €1,000 saved with which you can invest from the get-go, and can afford another €500 per month to invest, growing this amount 5% each year.

This scenario shows us that even if you can’t invest a significant amount of money each month, if you start out with a solid investment and make regular contributions, you can still become a millionaire in 30 years. But, even if you don’t get to the millionaire target, it’s still a good idea to have a well-defined goal. This will provide you a benchmark to work toward and help build your financial freedom.

Try it out yourself

The previous investing examples should give you a good idea of how to successfully invest to become a millionaire. However, everyone is different, so you should make sure to determine your investing strategy based on your own personal financial situation. Now it’s time for you to create an investment plan of your own.

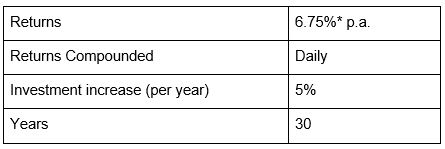

You can do this by creating your own simulations using Go & Grow’s simple calculator. To do so, navigate to your Go & Grow account, click the icon on the upper right corner, and select Forecast. Here you will be able to input your current starting amount, monthly investment, and how many years you are looking to invest.

This will show you how Go & Grow will build your savings, and how your net worth will be positively impacted through this process.

Use the Go & Grow forecast tool with various different inputs to see the different investment plans you can use to grow your wealth.

*As with any investment, your capital is at risk and the investments are not guaranteed. The yield is up to 6.75% p.a. Before deciding to invest, please review our risk statement or consult with a financial advisor if necessary.